TVO Market Barometer 7-26: Is Facebook taking down the entire market?

Stock market history was made on Thursday as Facebook took the single biggest one-day market value drop of all time. An overreaction as far as price? Most likely.

As far as volume is concerned, though, the forces at be seemed to already sense that something was brewing. And they apparently got a jump on things this past Tuesday, as the indices were hit with a pretty heavy spike of overall volume, logging a distribution day on the Nasdaq (despite Google’s earnings beat) while the big board was left relatively unscathed.

Does this imply that smart money already knew about the FB miss? Well, whether or not you believe that such insider practices exit, let’s just say it’s their business to hire folks to make well-informed investment decisions. How they get their info, is anybody’s guess.

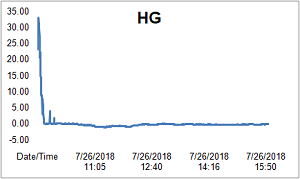

Like last Tuesday, overall volume in Thursday’s session had a huge jump, but looking at our Heat Gauge, advancing and declining volume was split right down the middle for nearly the whole day. Those folks who are currently poised to benefit from Facebook “taking down the market”, are not only a bit off the mark, but the opposite reaction is already underway as far as internals are concerned.

As for the reasoning behind it all, it could have been more “in the know” anticipation of Amazon’s after the bell earnings, or it might be the anticipation of tomorrow’s better than expected GDP number. What ever it is, as traders we don’t really care.

Well, maybe we do a little, but our trading decisions are based on what the market is currently doing right now. Let those big boy analysts worry about what the market is going to do next. As long as there’s volume to show where they’re headed, we can just sit back and follow their lead. -MD

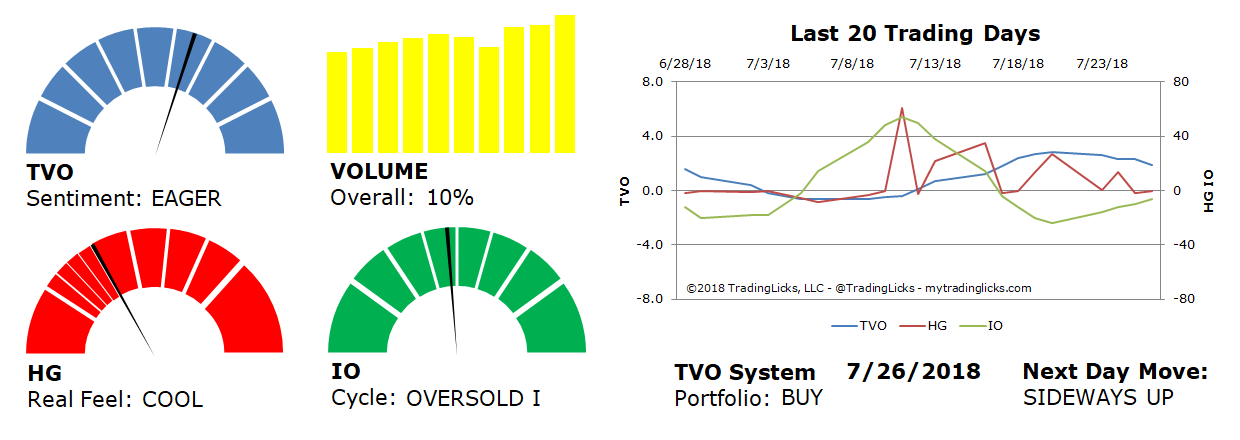

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: 10% – Today’s volume was higher than the previous session.

Real Feel: COOL – Bulls and bears were at a stalemate for the session.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS UP -Â The probability that SPY will close positive in the next session is 55%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.