TVO Market Barometer 7-24: How do you make money while you sleep?

It’s been an exciting earnings week so far, with much more excitement (and perhaps a few surprises) yet to come. Some say the next few days are crucial as to what 2018 will bring to the stock market.

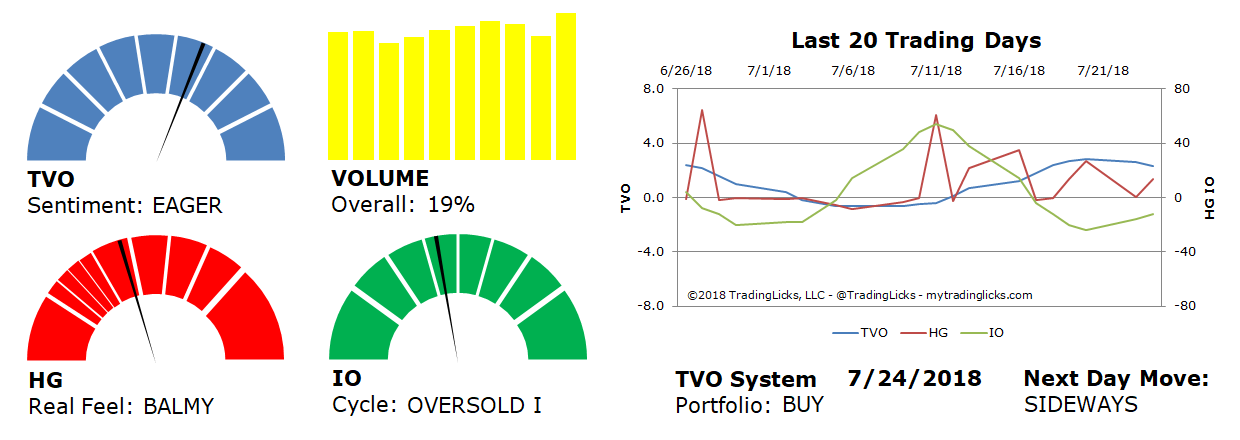

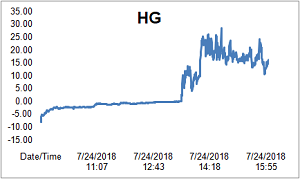

If you look at the volume in Tuesday’s session, though, there are some smart money folks who seem to be already well in step with that hypothesis. Overall volume rose almost 20%, and according to the Heat Gauge history, the bulk of it came in the earlier part of the session… A highly fueled FRIGID gap up turned into a slightly less than enthusiastic fade, ending the day in the BALMY category.

We were able to take advantage of today’s pop by selling our SPY calls from last Friday’s “Next Day Move” at the close for a +17% gain.

Hmm… so you’re probably thinking, that’s all well and good, but it would’ve been more than double that if we sold at 11am.

But it’s next to impossible to catch the high of the day just right like that, isn’t it? No not really. There are guys that do it all the time.

If you do decide to go down that path, however, keep in mind that along with the days you got out early before the market turned lower, there will also be days when it turns higher… Much higher, and you’ll end up missing out on even greater gains.

Selling at the close, one of the most effective tools in a swing trader’s toolkit, captures the “true price” of the market and statistically smooths out all of the intraday noise over time. In addition, it allows you the time to not only to have a life during the day, but also enjoy it free from the stress of chasing prices around.

The great Warren Buffet once said “If you don’t find a way to make money while you sleep, you will work until you die.” Sleep, health, family, free time, etc. are things you just can’t put a price on.

This was the 4 straight win for the TVO System (out of 5 trades this month), bringing our total account return up to just over +7% for the month of July alone.

Not too shabby, but how do I spend my time if I’m not watching the market all day?

Anyone that reads this blog knows that when it comes to volume, I’ve spent countless hours analyzing the data here so you don’t have to. And it’s an ongoing process of backtesting and statistical analysis that keeps all of our strategies at a high level of performance.

Okay, okay, I also do a lot of hiking and gardening. I play music, and occasionally I do get some sleep… but sometimes not until after the opening bell. -MD

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: 19% – Today’s volume was higher than the previous session.

Real Feel: BALMY – Bears were in control of the session with considerable buying under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.