TVO Market Barometer 11-29: If you don’t like the trade, wait a minute.

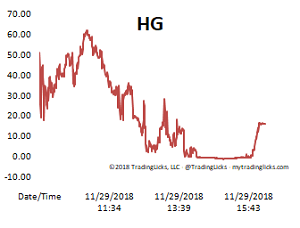

On Thursday, the S&P 500 was met with resistance at the 200 day MA (were you really expecting anything different?), as investors digested their gains as well as the comments from the Fed. The bullish case for a continued rally, however, remains strongly intact.

First we had the greater than 100% volume day on Monday (which was 2 whole days before Powell’s speech. You think someone knows something here?), followed by the confirmation rally on Wednesday. The bears will argue that the big volume was Wednesday and the confirmation is yet to come, but let’s just say this whole volume analysis thing is our little secret, okay?

We sold our SPY calls from 2 weeks ago for a modest 5% loss, which is a much better outcome than if we used stops and put them just below so-called logical support levels (like SPY 267 for example). Up here in New England, we have an expression that goes like, “If you don’t like the weatha, wait a minute.” It may be a tough pill to swallow, but sometimes the best way out of a trade you’re not too crazy about is to wait it out a bit.

How long do you have to wait? Our TVO System is designed with this thought in mind and through historical probability, it can tell us exactly how long to wait to exit a trade so we can avoid panic selling and still have the safest, and most profitable outcome.

TVO, our volume oscillator, has once again shifted, but now it’s headed back up towards positive values. Next up for most folks on Wall Street is the climb up the wall of worry. If you understand volume, though, there’s really a lot less to worry about. -MD

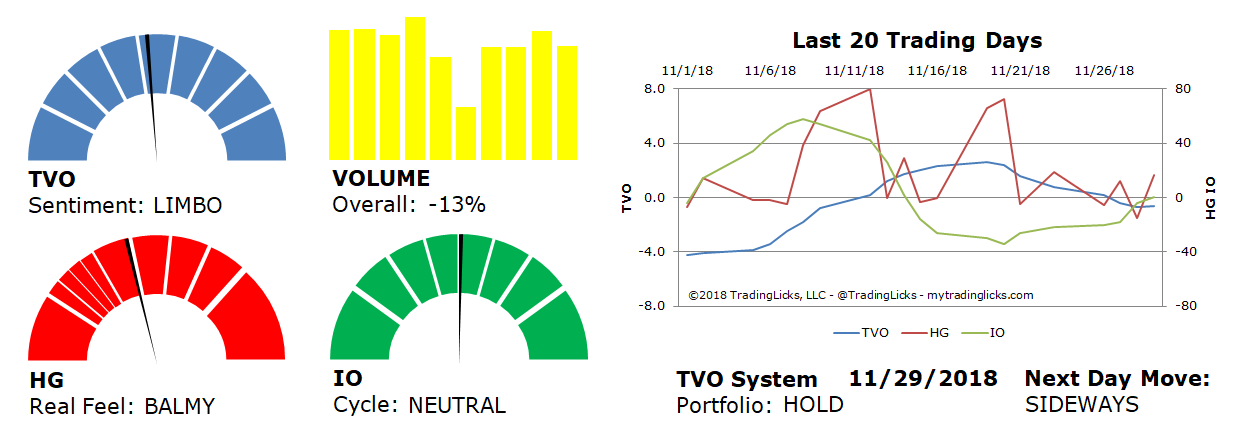

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -13% – Today’s volume was lower than the previous session.

Real Feel: BALMY – Bears were in control of the session with considerable buying under the surface.

Cycle: NEUTRAL – Retail investors have no clue what’s going on.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.