TVO Market Barometer 11-27: When volume talks, prices listen.

In markets a week ago, what started out as a drop destined to usher in new lows, has now slowly transformed into the makings of a constructive climb back to the 200 day MA. There are folks that say there are plenty of hurdles before (and if) that happens… like certain “resistance levels”, Powell’s speech, and the political events set to transpire over the weekend.

But as usual, there are some things brewing related to volume and internals that are not so easy to spot if all you’re focused on are up and down moves in price.

TVO, our long-term volume oscillator, has slipped into negative territory, as big institutions are apparently taking a breather, which seems to confirm the uneasiness in the air over the holiday. The good news for the bulls, though, is that out of all of the down days this month, only one so far (11/20) falls into the across-the-board distribution category.

And then there’s the +113% increase in overall volume that we had on Monday.

At first glance, you might just attribute it to a post-holiday bump, but historically, greater than 100% volume increases just don’t happen very often (The complete list going back to 2005 can be found at this TVO MB post). The past few occurrences, including 2017, were followed by extremely large moves in the market. Last year’s +108% volume increase ignited the fire that started the euphoric rise to the market peak back in January of this year, adding 26 points to SPY along the way.

Whether history repeats this time remains to be seen, but there is thing one thing to keep in mind… In the tangled relationship between volume and price, volume almost always speaks first. Then it’s up to price to get in the last word. -MD

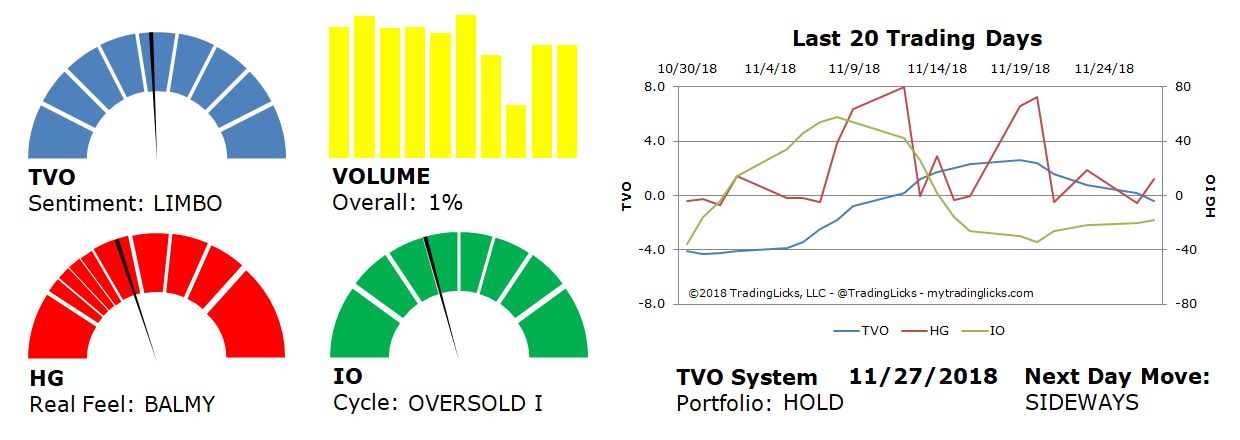

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 1% – Today’s volume was higher than the previous session.

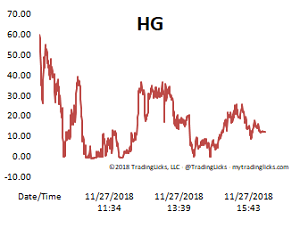

Real Feel: BALMY – Bears were in control of the session with considerable buying under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.