March came in like a bear, out like a bull. – TVO MB 3-29

There’s an old saying that “If March comes in like a lion, it will go out like a lamb.” This year on Wall Street, the month of March came in like a bear and went out like a bull.

I’m not implying that this expression will now find its way into some stock market lore (and there are plenty more out there: “Escalator up/Elevator down,” “Sell in May/Go away,” to just name a few), but folks just can’t resist a good old phrase designed to keep them out of trouble… even if it has absolutely no basis in reality or historical fact.

Will the same prediction hold true for next year and beyond? Who knows? I surely wouldn’t bank on it.

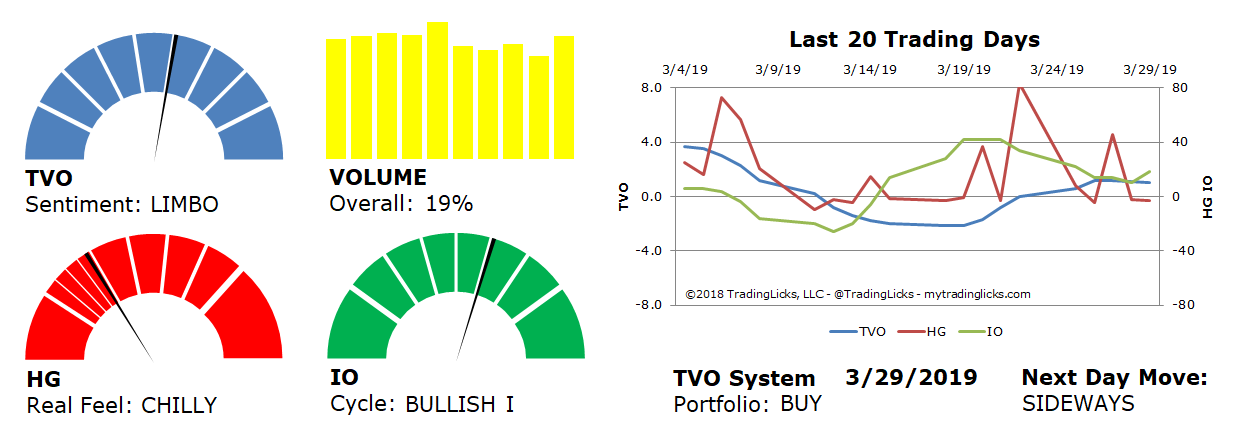

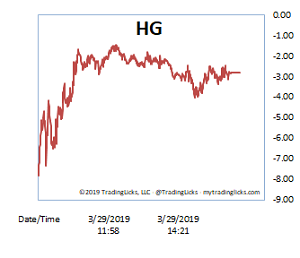

Markets rallied on the last day of March (and the quarter) logging an across-the-board accumulation day, with the Heat Gauge staying in the CHILLY range for most of the session. It appears that the battle for S&P 2800 has been settled in favor of the bulls at this point. TVO, our volume oscillator, is heading down towards zero, however, so if we are indeed looking to break the previous high (and destroy the weekly H&S pattern once and for all), the big institutions may first need to recharge their batteries.

The big catalyst on tap to watch out for this week is, of course, the jobs report. How it will play out is anyone’s guess, but if you’re looking for a catch phrase to keep you on the right track, well, my all-time favorite is “Volume precedes price.” It may not be as catchy as something like “April showers bring May flowers,” but it is one you can surely bank on. -MD

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 19% – Today’s volume was higher than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: BULLISH I – Retail investors are confident and slightly overweight in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.