TVO Market Barometer 8-02: In the stock market there are 3 things…

In the stock market there are 3 things you can be sure of… The run-up, the buy-back, and the shake-out (the last one is not usually hyphenated, but we’ll do it here just for emphasis), all of which occur in many time frames ranging from a few days to several years.

The run-up basically means that no matter what happens, over time, the market will always go up. It’s just the nature of things. If it doesn’t go up, then why are we doing it?

Then, of course, there are cases where the market does not go up and that’s where the buy-back comes in. This usually happens when most folks have either thrown in the towel, gotten tired of waiting, or maybe they’re giving something else a try (like crypto, perhaps?). The newly lightened load proceeds to entice the old crowd back in to start the run-up again.

And how did the load get lightened in the first place? The good old shake-out works on nervous investors and their nervous systems. Since they are prone to loss-aversion (which makes up most of us), they’re constantly looking for a reason to think that the big crash is just around the corner.

Whether the reason is a calendar event (like the fed or end of the month), or media hype, or just flat-out price manipulation, it really doesn’t matter. Human nature takes its course and people flock to the exits like a building is on fire.

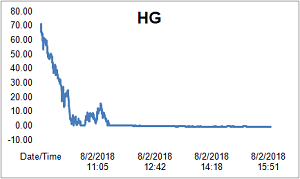

Thursday’s gap down was a classic shake-out, but what about the run-up? When looking at it from a volume perspective, a big accumulation day brings plenty of institutional players on to the field regardless of the extent of the price action. When there are too many players, sometimes it actually prevents the price from going higher.

Tuesday’s accumulation day gave the market all the fuel needed (overall volume rose 11%) to cue the shake-out. When the big boys give a signal like that, it’s best to either stay out of the way or jump on for the ride.

And then there are all the doubters out there convinced that this kind of market behavior is “sketchy” and that bots are running the show (and perhaps they also believe in flat earth and the moon landing was fake). They might see things differently if they come to realize that volume precedes price… not the other way around.

But human nature is what it is and there are people who stick to their beliefs like glue. And that’s something you can certainly be sure of. -MD

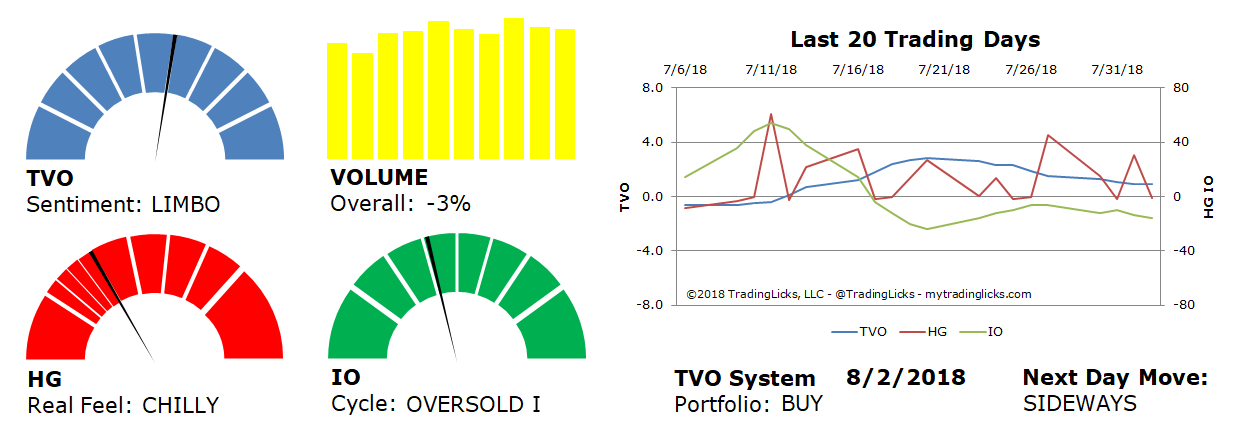

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -3% – Today’s volume was lower than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.