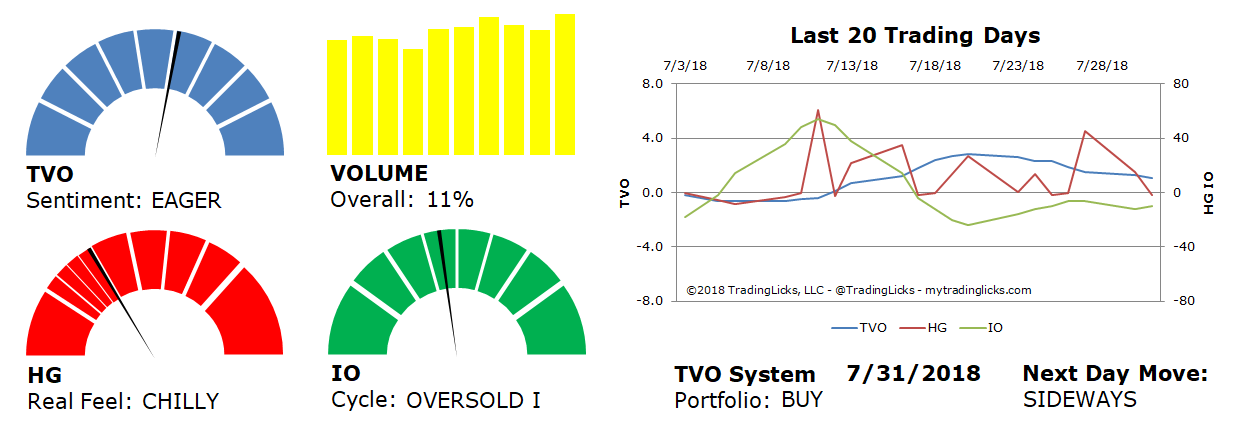

TVO Market Barometer 7-31: Will lightning strike again for the bulls?

Tuesday was the last day in July and we managed to squeeze in yet another across-the-board accumulation day, the 3rd one of the month. Things are looking so good that, according to analysts (who also seem to know the future outcome of the mid-term elections), the bulls have now been given the green light for the rest of 2018.

They’re saying that the kind of gains we’ve had this year have only occurred 2 times in all of history, and both times the S&P went on to stellar gains in the latter part of the year. Well, the success of that theory, depends on how confident you are with lightning striking the same place 3 times, let alone twice.

Quantitative analysts and system traders are not looking for rare 2 or 3 time events… we’re looking for things that have happened at least 40 to 400 times or more. We put our confidence in things that happen over and over again, because those events are much more likely to continue.

Think of it another way. A 75% win rate seems impressive, until you realize it could mean just 3 wins out of 4. In that sense, it’s really the sample size that makes the win rate truly authentic. That’s why putting your money behind a 60 to 65 percent strategy with regular occurrences (like our Next Day Move) actually has much better odds than an 80 to 90 percent (or a twice in a lifetime) approach that triggers once in a blue moon.

With that said, getting back to volume, TVO, our volume oscillator, reversed during July and has since been on course towards negative values. If things continue on this path, the second half of 2018 may end up a bit rockier than forecasted. For the time being, and there’s no time like the present, accumulation mode is still alive and well. -MD

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: 11% – Today’s volume was higher than the previous session.

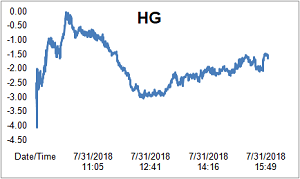

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.