You call it chop. TVO calls it consolidation. – TVO MB 3-05

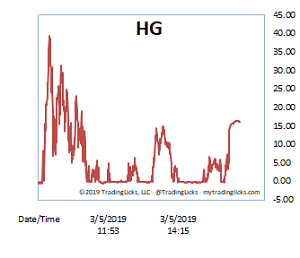

Tuesday’s session was choppy and also what many folks would call unproductive, as far as price. Volume, on the other hand (which always has something up its sleeve), went mostly for the bears, as the drop at the open nearly brought our Heat Gauge into the SWELTERING range.

Whether the huge spike of down volume was the total extent of the damage or a warning shot of more to come, remains to be seen.

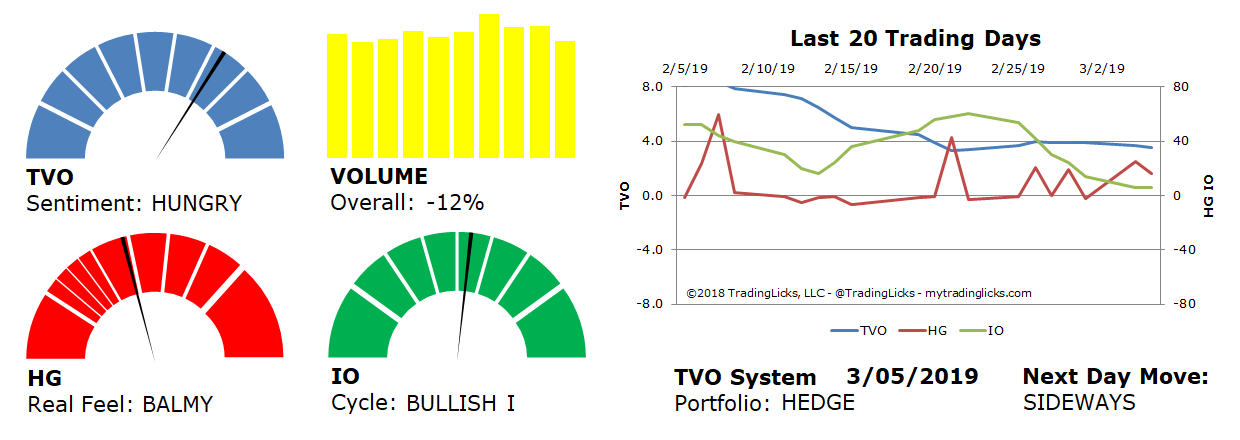

TVO has resumed its downward direction, but we’re just above the 0 to +3.0 “healthy market” range. As long as we remain in that range (which now just happens to coincide with staying above the 200 day MA), it’s risk-on for the bulls.

In the meantime, expect some more chop, or as it’s known in more technical terms: consolidation… which we all know is indeed quite productive in more ways than one. -MD

Sentiment: HUNGRY – Markets are accumulating at an accelerated rate and big institutional buying is heavy and aggressive.

Volume: -12% – Today’s volume was lower than the previous session.

Real Feel: BALMY – Bears were in control of the session with considerable buying under the surface.

Cycle: BULLISH I – Retail investors are confident and slightly overweight in their holdings.

Portfolio: HEDGE – The market is over saturated and long-term investments warrant some protection.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.