Will the tariffs wreak havoc or are they already priced in?

The trade war once again gets the blame for Thursday’s market action. Of course, traders out there know it was really just a classic technical market move in all it’s glory. But the “hope of a deal” along with “a beautiful letter” from China is a far better headline than “SPY tested the 283 gap and took out all the stops,” so tariffs stay the main focus for now.

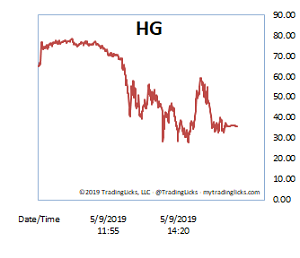

After Tuesday’s high volume plunge and today’s drop from SCORCHING to TORRID on the Heat Gauge, a technical bounce from here is likely… regardless of how the trade war saga plays out. And yes, the big volume doesn’t have to happen on the exact day of the reversal. Volume precedes price and markets are always striving to price in events long before you or I hear about them in the news.

The question is how long does the relief rally last? Well, it really depends on the resolve of the institutional investors that didn’t jump ship already. Tuesday sits as a lonely across-the-board distribution day at the moment, so there are still plenty of folks on board. TVO has been on course for negative values, though, so I’m inclined to say that dip buyers may want to take gains when they can in the near term and not bite off more than they can chew. -MD

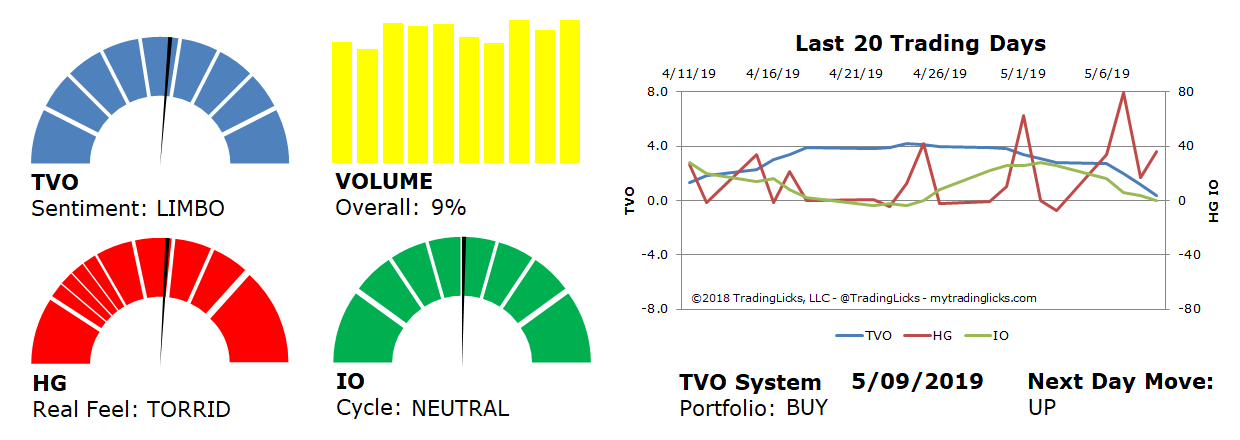

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 9% – Today’s volume was higher than the previous session.

Real Feel: TORRID – Bears were in control of the session with moderate buying under the surface.

Cycle: NEUTRAL – Retail investors have no clue what’s going on.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 59%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.