Who needs dark pools when you’ve got light pools. – TVO MB 2-26

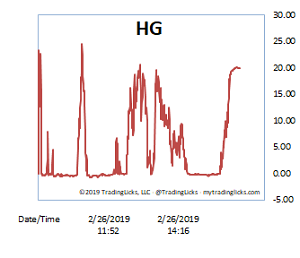

Day 2 of the great SPY 280 pullback was not much more than a gap fill by price standards. Volume, on the other hand, was far more turbulent, with large spikes on the Heat Gauge throughout the session.

I like to think of these spikes as “light pools” (kind of the opposite of so-called dark pools), because you can see them and the enormous sell orders they represent, as plain as the light of day. This type of volume action has been observed here before and is often followed by a much larger dip in the indices.

Whether it’s just routine end of the month profit taking or a dire warning of Thursday’s GDP number remains to be seen. Either way, if you’ve sold your December low SPY 240ish position and have been sitting in cash waiting for action, it looks like you’re going to get it soon. -MD

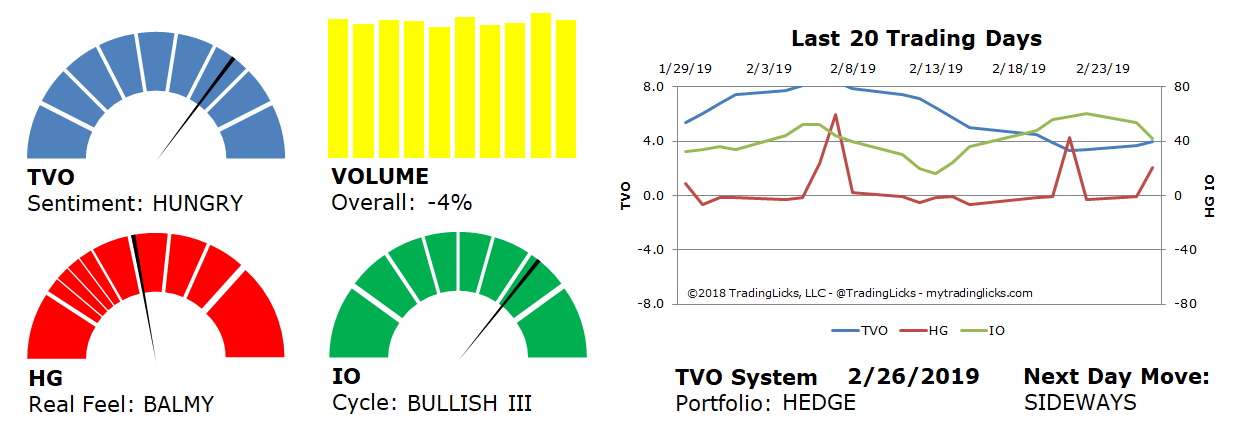

Sentiment: HUNGRY – Markets are accumulating at an accelerated rate and big institutional buying is heavy and aggressive.

Volume: -4% – Today’s volume was lower than the previous session.

Real Feel: BALMY – Bears were in control of the session with considerable buying under the surface.

Cycle: BULLISH III – Retail investors have bitten off way more than they can chew.

Portfolio: HEDGE – The market is over saturated and long-term investments warrant some protection.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.