TVO Market Barometer 8-23: Who exactly is buying this market? TVO knows.

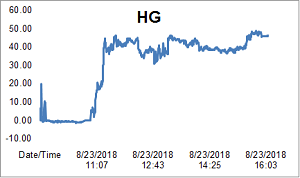

The Thursday morning run up barely made it past 10:30 AM when SPY 287 was rejected once again. This time, however, the result was heavy volume distribution (as opposed to Tuesday which was high volume accumulation).

It’s not out of the ordinary to see a head to head clash between bulls and bears at prior resistance levels. For anyone keeping score, though, (which is basically the primary function of this blog) the bears are actually leading the game this month with far more distribution in their corner.

But if smart money is heading for the exits, why do prices keep testing all-time highs? Who the heck buys up here anyway?

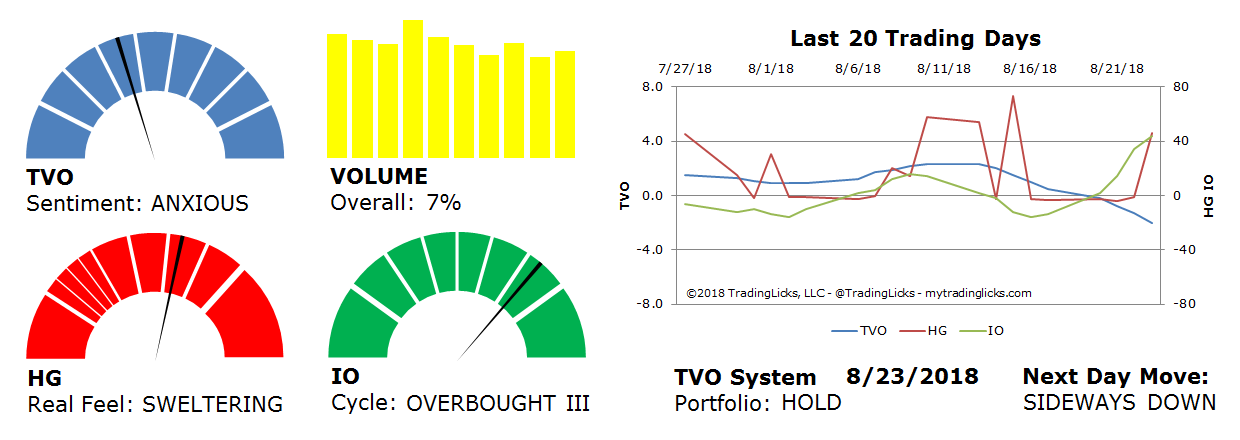

Well, it works like this… High prices scream out to the FOMO crowd (Fear Of Missing Out), who are mostly retail investors. You can see how those folks are lined up right now by looking at the OVERBOUGHT III reading on IO, our Issues Oscillator. Meanwhile, big institutions have already slowly begun their profit taking process. Slowly enough, in fact, that it often takes weeks before price catches up to what we already see in the volume. TVO, our volume oscillator (now showing ANXIOUS), has been declining since the second week of August.

At some point things will reach critical mass and something has to give. How much things will give is anyone’s guess, but where volume goes, prices will ultimately follow. And this cycle continues over and over again, regardless of the odds of impeachment, EU uncertainty, trade wars, etc.

But doesn’t the market care about all these things, though? Of course it does, but as a trader you only need to care about where we are in the cycle (which you already know if you regularly read this blog). The rest is just positioning yourself accordingly. -MD

Sentiment: ANXIOUS – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: 7% – Today’s volume was higher than the previous session.

Real Feel: SWELTERING – Bears were in control of the session with a slight trace of buying under the surface.

Cycle: OVERBOUGHT III – Retail investors have bitten off way more than they can chew.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS DOWN -Â The probability that SPY will close positive in the next session is 51%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.