TVO Market Barometer 7-12: How do you know when to sell?

Wednesday’s shakeout went exactly according to plan, lightening the load which then paved the way to Thursday’s rise. The bulls didn’t quite get their SPY 280, but the Nasdaq closed firmly at all-time highs.

TVO, our volume oscillator, is now above zero and our portfolio approach has shifted to BUY mode. At 4pm on Thursday, we closed out our long-term SPY calls for a +29% gain in what was the strongest close since we opened the position back in May.

But wait, if the market is so healthy and everything is fine and dandy, why the heck did we sell? Is the big crash finally coming?

Sorry to disappoint the bears out there, but the reasoning behind our exit strategy comes from years of solid research and data analysis and has nothing to do with recent headlines. And while our track record of successful exits are based on many factors, the core idea of how and why it works is that we sell into strength.

Selling when it seems like the whole world is buying is not an easy task to say the least. So how do you do it? We use a rules based process that assures that we get out when the going is good without allowing ourselves to get in the way. We just simply follow the rules… no questions, no exceptions.

And then there are the folks that say you should “let your profits run.” Well anyone who has traded options long enough knows that if you wait too long to sell, your profits will run straight into the ground, or disappear altogether.

Will the market go higher from here then? Well, of course it will (otherwise what’s the point of having a stock market in the first place), but short-term we’re looking at some pretty extreme overbought levels (IO, our Issues Oscillator, is at OVERBOUGHT level III). Chasing higher in this kind of environment may not exactly put risk vs reward in your favor. Letting the trades come to you is a far more productive plan.

So the next time you open a trade, define your exit rules and follow them (otherwise what’s the point of having rules to begin with). Because when it seems like everyone’s jumping on the bus, it may be just the time to wait for the next one to come along. -MD

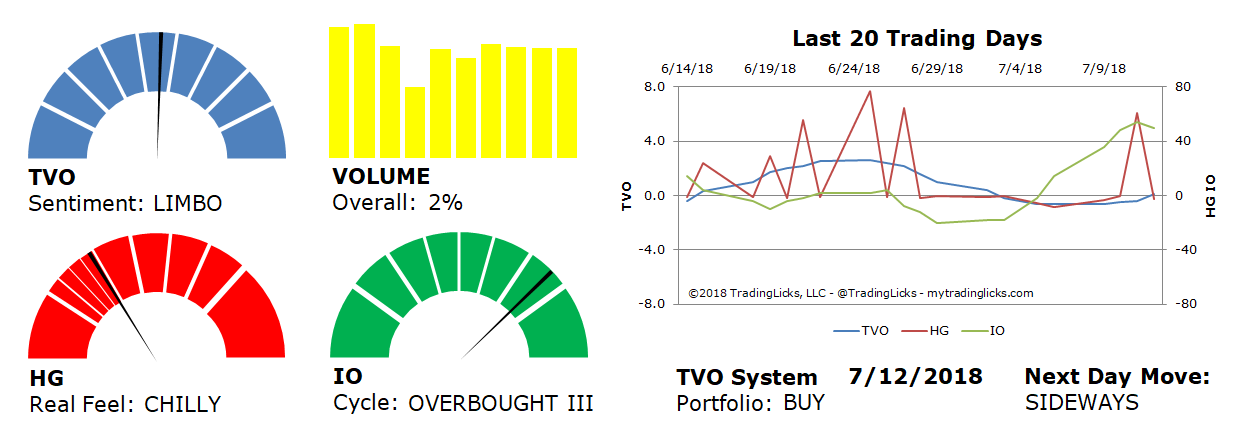

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 2% – Today’s volume was higher than the previous session.

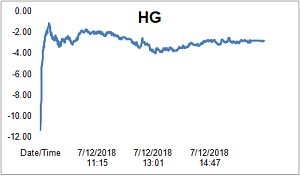

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERBOUGHT III – Retail investors have bitten off way more than they can chew.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.