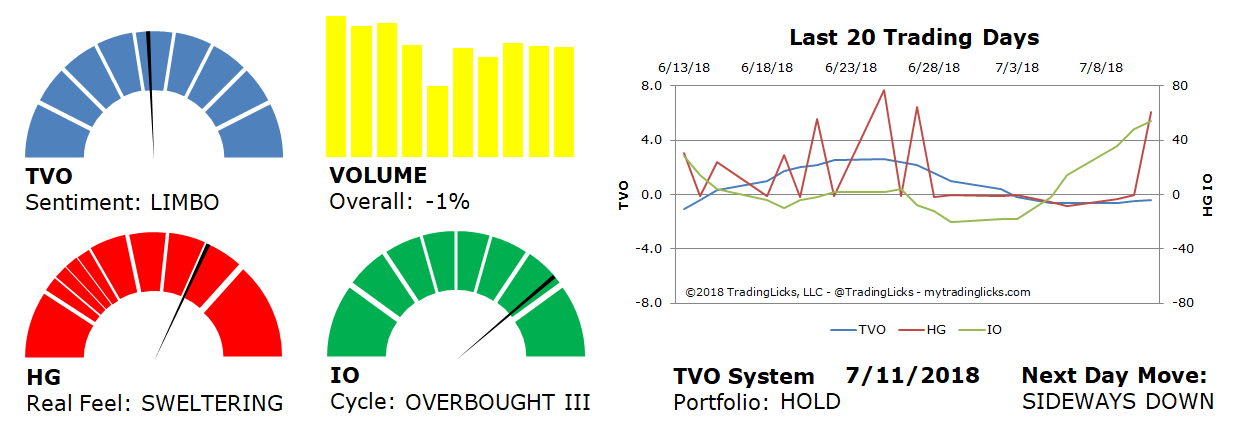

TVO Market Barometer 7-11: Is it SPY 280 this time or a correction of time?

The shakeout was right on schedule and under the surface it did pack quite a punch. Overall volume pulled back slightly, but the Nasdaq managed to log its first distribution day in the month of July.

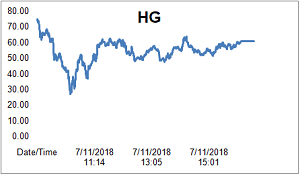

All eyes are on the great prize, though, which is SPY 280, and even quite a few bears are hoping to get there before (or if) we fill the 276 gap below. And then there’s the more frustrating prospect that neither level will be reached any time soon, with a correction of time taking us straight through next week’s Fed testimony.

However it plays out, internals are still holding steady as far as volume is concerned. So “the big one” that the trade war fear mongers keep warning us about with every down tick, remains on hold for now and probably will for quite some time to come. -MD

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -1% – Today’s volume was lower than the previous session.

Real Feel: SWELTERING – Bears were in control of the session with a slight trace of buying under the surface.

Cycle: OVERBOUGHT III – Retail investors have bitten off way more than they can chew.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS DOWN -Â The probability that SPY will close positive in the next session is 51%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.