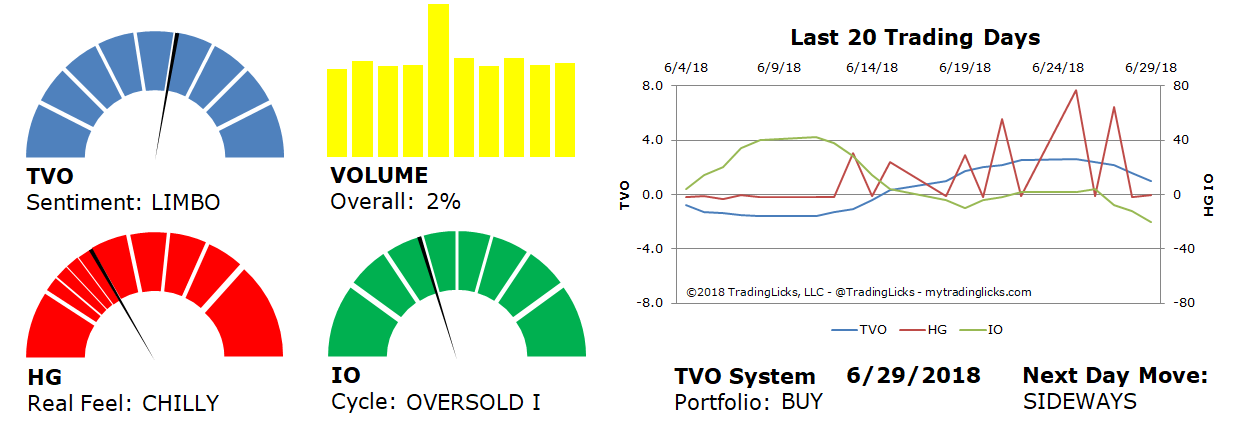

TVO Market Barometer 6-29: Will markets snap or fill the gap?

The bulls finally got the volume they needed last Friday, but a sudden wave of end-of-the-quarter profit taking swept through late in the session, leaving the S&P once again close to flat for the year.

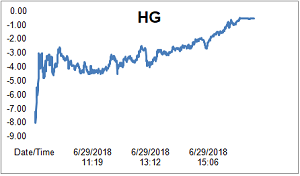

On the other side, though, the bears didn’t accomplish much, as HG stayed CHILLY into the close, with a steady flow of buyers (especially on the Nasdaq) keeping things under control.

With the Fed looming over the holiday week ahead, folks are wondering if the market correction length is about to set a new record (the longest being 122 days back in ’84). It’s a short week and not a lot of time for SPY to regain 280, however, the 274 gap is clearly within reach. Then again, so is the 200 day MA.

TVO has shifted into LIMBO and markets are once again in “wait and see” mode. Whether they’re waiting for the Fed (to tell us all what we already know) or something far more elusive remains to be seen. -MD

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 2% – Today’s volume was higher than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.