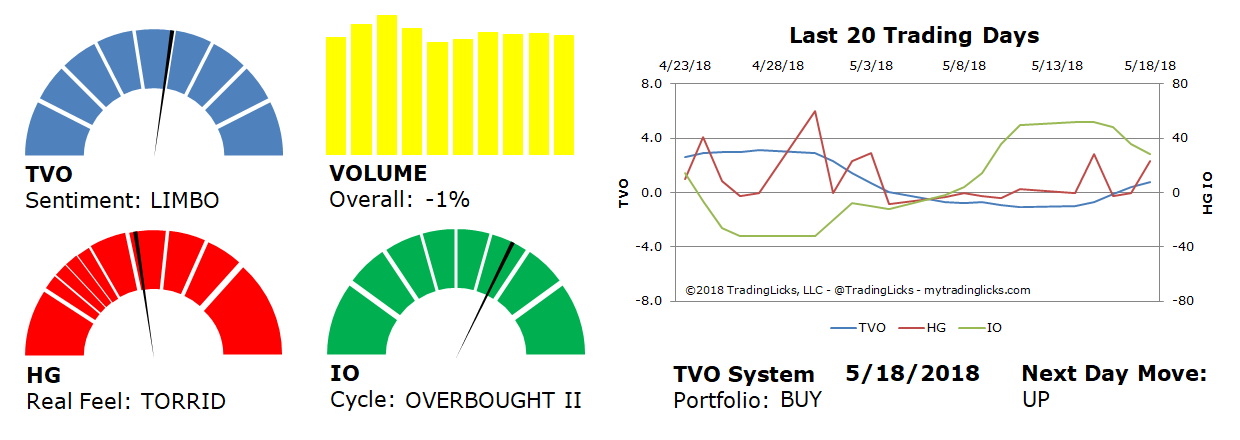

TVO Market Barometer 5-18: With volume, a little goes a long way

Back on 5/9, the S&P 500 broke above the 50 day MA on strong volume. Since then, decreasing volume has had the shorts foaming at the mouth for what seems to them like sure signs of the “next recession.” But what those folks fail to realize is that corrections are not only measured in price, but also in durations of time.

The tight range of the past week and a half fits the bill as a classic low volume “correction of time.” TVO, our long-term volume oscillator, already had all this figured out when it reversed on 5/9 (which was an across the board accumulation day) and on 5/17 when the values rose above zero (shifting our long-term portfolio approach into BUY mode).

And when the general consensus last Friday was dictated by the bears and the “you’ve gotta be crazy to hold over the weekend” folks, we did just the opposite and only paid attention to Next Day Move (which said UP)… and we bought more calls. Our “calls only” approach has our account firmly on track towards a complete recovery from the hit most traders took earlier this year.

There is the Fed to look out for this week to interrupt the next leg up party, but if momentum continues, the break in the action (if any) will be a quick one at best. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.