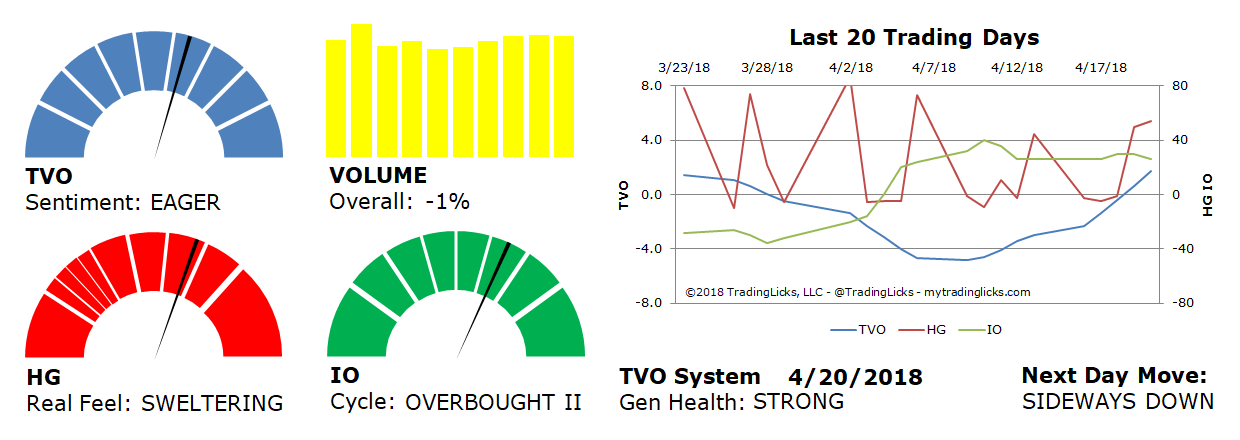

TVO Market Barometer 4-20: Time to buy the pullback?

The third week in April had some notable events, including the Boston Marathon, Tax day… and 3 consecutive accumulation days on the NYSE. The sudden bull rush was subsequently followed by some distribution, but volume across the indices declined overall. That may seem like good news for the bulls, but from a volume perspective, reversals tend to rise up after large spikes in volume at either end of the spectrum.

Our Heat Gauge, which was around 54 on Friday with the bears firmly in control, generally needs to be closer to 100 before a potential reversal can take hold. Sometimes, though, a higher volume flush could be just the start of more waves of selling. How do we know when it’s just the right time to buy the pullback? That’s where probability from extensive backtesting comes in.

As for the last week in April, the most notable event coming up is Stocktoberfest East in NYC. Last year’s list of speakers was nothing short of spectacular, and this year is looking even better. Looking forward to connecting again with all the amazing folks from the StockTwits community. Hope to see you there! -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.