TVO Market Barometer 3-27: Can this market pass the duck test?

Today I asked my friend RK (who just happens to be one of the country’s the top fund managers) how his positions were doing in the recent market downturn. His response was “I’m waiting for the market to crash.” A bit confused, I replied, “But what about the S&P 500 dropping suddenly back to the 200 day MA, not to mention leading stocks breaking down and all the folks running scared from impending trade wars?” RK responded, “Feels more like fake scared… Real scared feels a lot different.”

Which brings to mind the age old adage: if it walks like a duck, quacks like a duck, well then it may very well be a double bottom until proven otherwise. And the classic double bottom pattern plays out the way it does for one simple reason… folks are scared into selling before what seems like the “inevitable second leg down.” Of course the second leg turns out to be just another shaking out of the weak hands and a reversal swiftly follows. Ask yourself right now, how scared to you really feel?

The bulls who are looking for the quiet climb up the “wall of worry” may want to come to terms with the fact that all this volatility they secretly wished for all last year will likely be around for a while longer. Whipsaw moves are par for the course during any kind of bottom and can lead to tremendous opportunities on both sides, but not for those on the sidelines. And for all bears just getting ready to sink their teeth into this thing… do you really want to be the guy that shorted the 200 day MA (one of the strongest lines of support there is) that has yet to be broken?

I think I hear ducks quacking.

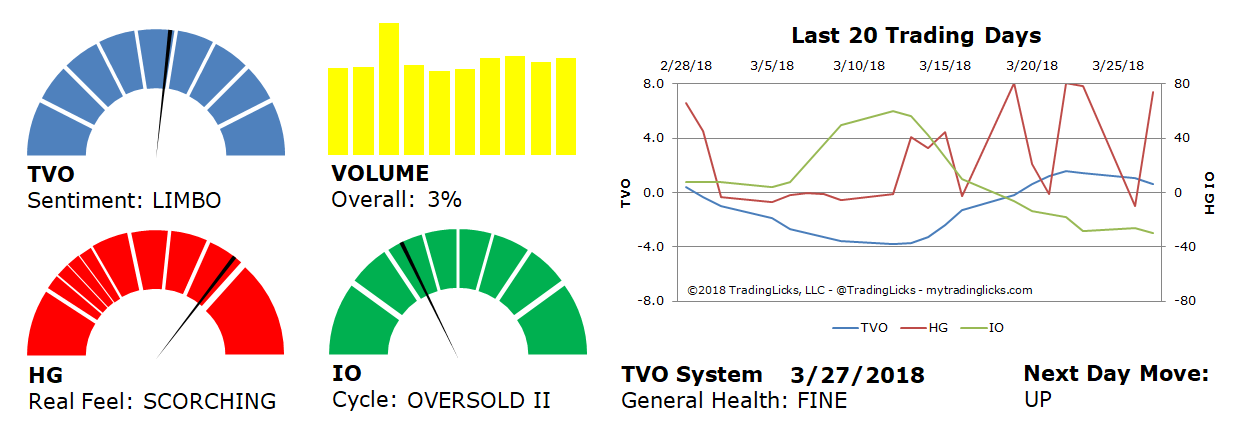

That’s not to say that an undercut of the February low is out of the question. TVO, our volume oscillator is once again headed towards negative values, so the road may be a bit bumpy ahead in the short term. While Tuesday was another across the board distribution day, the heavy selling on the Nasdaq saw only a very slight bump in overall volume. We’ll have to wait and see if heavier volume selling can back up the “second leg” bearish hypothesis.

Until then, let’s just call a duck a duck. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.