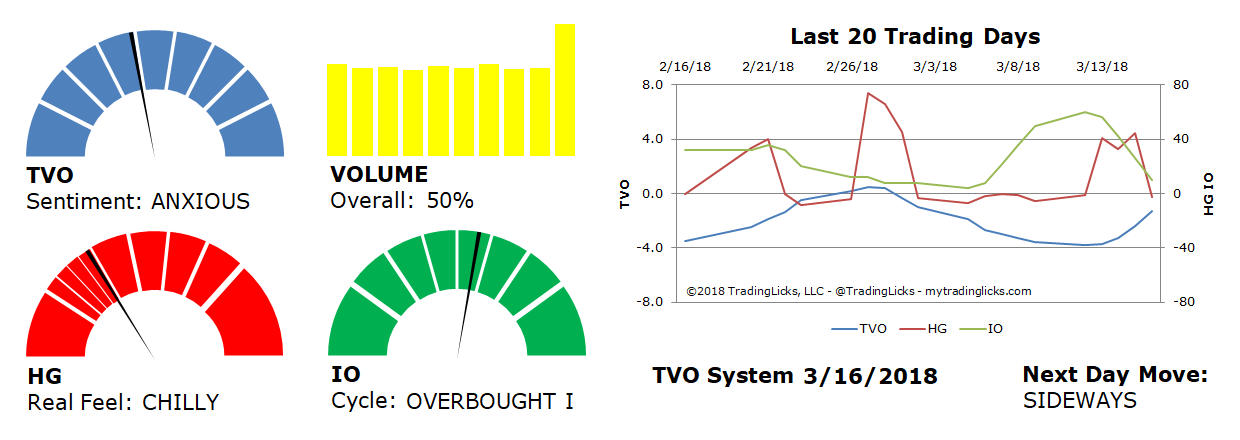

TVO Market Barometer 3-16: Is smart money worried about the Fed?

As anticipated, the gap just below SPY 275 was neatly filled (within a few cents), and now investors eagerly await the long anticipated Fed meeting this Wednesday. The general feeling in the air is that nobody seems to know for sure how the rate raising will go in 2018. From a volume perspective, however, smart money folks are already teeming with bullish anticipation.

Aside from a tumultuous start, the month of March (in like a lion) has been mostly all about accumulation. This past week’s pullback shook the big board up a bit, but we ended firmly on Friday with an across the board accumulation day (the second one this month)… even though markets went down.

How is this possible? As it was once famously said, “with volume all things are possible” …or at least closer to the truth than the often manipulated movement of price would lead us to believe (re-read the first sentence above about the “neatly filled” gap).

There are those who could point the finger at the unusual volume bump we got from quadruple witching (50% increase overall), but advance volume was also high and had our Heat Gauge quite CHILLY for most of the session. The pre-Fed shakeout may still have a day or two to go, but for the longer term, the bulls have big institutions on their side… at least until the SPY 280 gap gets filled. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.