TVO Market Barometer 2-7: Up from here or another leg down?

The legendary trader and market wizard Ed Seykota once said, “The elements of good trading are: (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance.”

After this week’s great computer generated “flash crash” of 2018 (which took complacent bulls and even some blood thirsty bears by surprise), we did exactly that.

We were fortunate enough to take some substantial profits, but the gains on the trades that remained open quickly receded. In a few day’s time, our overall account return went from almost an +11% gain at the end of January, to nearly a -12% loss.

For a time, I do admit that I was getting a little overzealous myself at the seemingly never-ending rally. Ultimately, though, we did remain true to our proven position sizing method, and kept our risk limited… sparing our account from what could have been a lot worse.

There are times as a trader when your position takes a hit, and you start to think things like, “it’ll come back if only I wait it out a little longer.” Sometimes it does, and sometimes it doesn’t. What most folks don’t realize is that the point you begin to make that assessment, your emotions have already started to take control.

Add on top of that a situation where the Dow falls over 1000 points, and you can see just how compromised a change in your trading plan, or “breaking the rules”, can be. And if you make an exception too many times, it starts to become a new rule in and of itself. The more rules you have, the more tempted you’ll be to break them, and the ever-growing complexity of your method will soon spiral out of control.

System trading takes your emotions, and you, out of the trade. Prior to every trade, system traders know there will be a well-defined entry and exit. There is no playing it by ear because decisions are already made in advance. With our own TVO System, entries and exits are based on high probability results from 16 years of backtesting and over 4 years of live trading.

If something goes wrong, you stick to the plan and cut your losses if you have to, and then go back and retest the strategy to see if it’s something you can improve… or if it was simply just a case of a wild market out of control. You may find it was a little of both. In any case, always be careful not to “overfit” your strategies with too much data and new ideas.

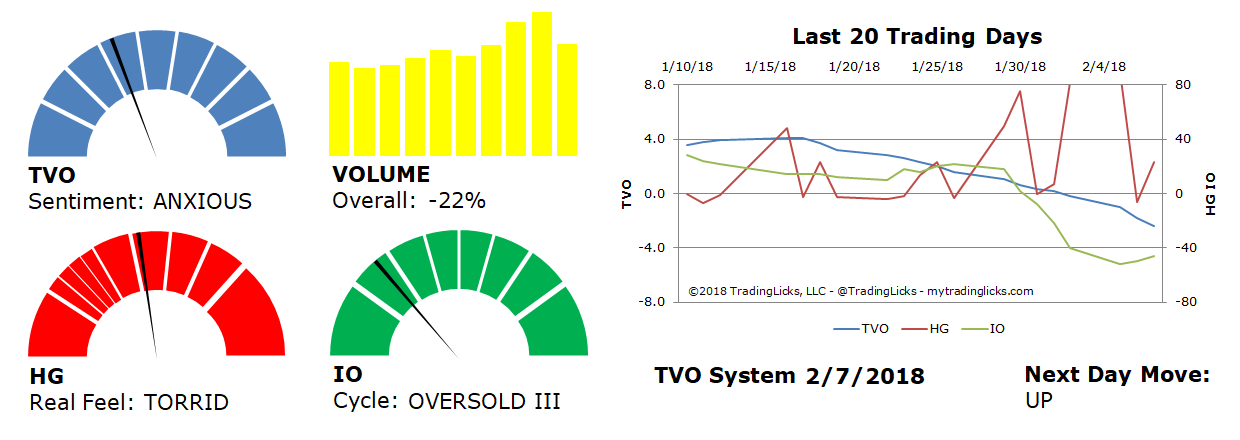

As far as volume goes, over the past few days, TVO has become ANXIOUS and is falling rapidly. The healthy “risk on” market environment has been interrupted until further notice. With the amount of room to run on the negative side of the oscillator (currently at -2.4), the possibility of another leg down cannot be ruled out, so be prepared for more wild days to come. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.