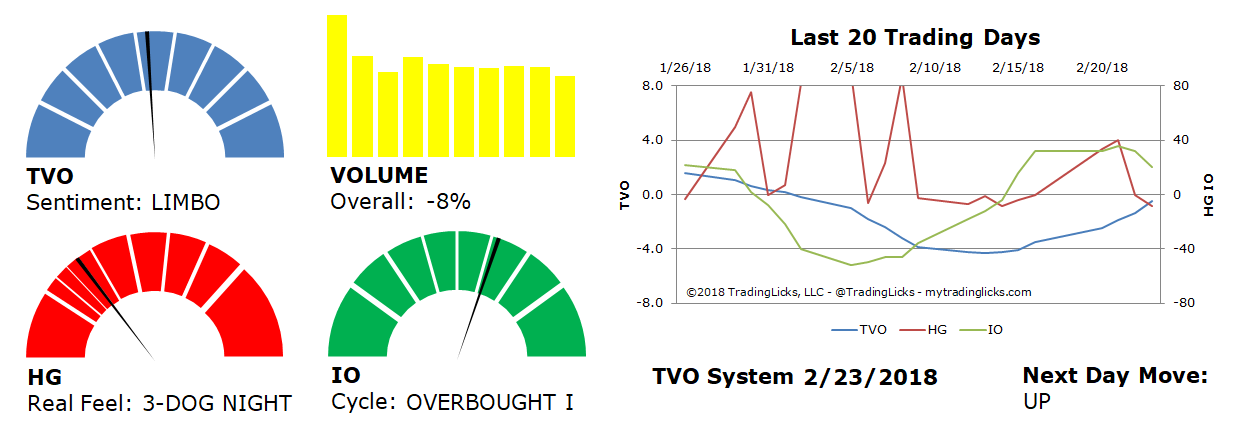

TVO Market Barometer 2-23: Is low volume a game changer?

Markets managed to reclaim the 50 day MA on Friday… and what do the bulls do after crossing this all too important institutional threshold? They complain that it happened on low volume. Unless those bulls are just looking for an excuse to become bearish, they may want to look just a bit beyond what they see, or at least just one day.

The month of February certainly may have come in like a lion, but it’s sure looking like it’s going out like a bull. From a volume perspective, the 2 biggest across the board accumulation days happened this month (2/6 and 2/14), which created the volume momentum that got us to where we are now.

How do you measure volume momentum? Well, it just so happens we’ve got an oscillator for that. TVO, our total volume oscillator, reversed direction almost 2 weeks ago (and is now nearly back in the “healthy market” range), which means big institutions have already made their commitment long before this whole 50 day thing.

Yes it would be good for the bulls to see a volume spike here, but that kind of push through almost always has just as many bears behind it trying to push it back down. Low volume now after some major rocket boosters a week ago, has the ship with just enough burn for a smooth short-covering drift into outer space. Fasten your seat belts. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.