TVO Market Barometer 11-20: How can a trader survive in this market?

Rates are rising, markets are falling, “buy the dip” has been declared dead and Cramer says sell everything. How can a trader survive in this market? Well, for starters you need to start thinking like a turtle… Like a “Turtle Trader” that is.

Back in pre-internet days, a small group of men and women with little or no experience in the financial realm (which actually turned out to be an advantage) responded to a modest newspaper ad. Each were given a million dollars and a short list of trading system rules. Five years and $175 million dollars in collective earnings later, the inspirational group known as the Turtle Traders can chalk up their success to 4 core principles: “Trade with an edge, manage risk, be consistent, and keep it simple.”

The system they used indeed had a proven edge, but did it work all of the time? Of course not. More often than not, the Turtles would have to persevere through large drawdowns, which inevitably led to self-doubt and questions like, “When a trade doesn’t go as planned, should I stop and change everything that I’m doing?”

Richard Dennis, the mastermind behind “raising” the Turtles, believed that anyone with a clear set of rules could become a successful trader. In reality, however, it’s not always that simple. “The key is consistency and discipline. Almost anybody can make up a list of rules that are 80% as good as what we taught our people. What they couldn’t do is give them the confidence to stick with those rules even when things are going bad.”

At the end of the day “good trading is not about being right, it’s about trading right.” Confidence comes from when you look beyond the success or failure of individual trades and focus on the system performance as a whole. Market downturns are inevitable, but if you let every one of them influence you to keep changing your strategy, rest assured your hard-earned edge will never again live to see the light of day.

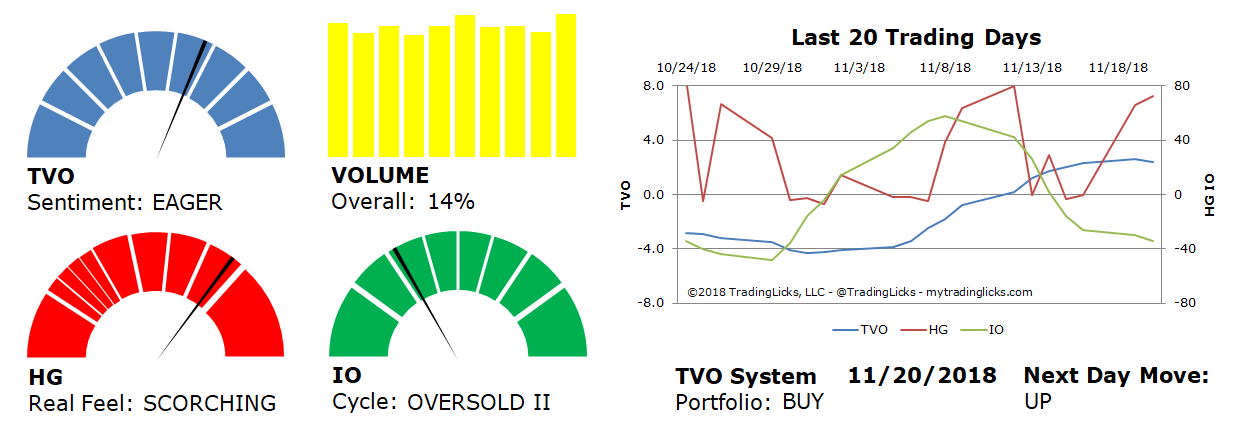

As far as volume on Tuesday was concerned, the day’s rout resulted in an all out distribution day across the board with an overall volume increase of 14%… Which may actually turn out to be a good thing for the bulls as bigger moves in volume are often found right before the points of bigger reversals in price (capitulation anyone?).

When volatility is running high, it’s not unusual for indices to suddenly move 1-2% or more in either direction. As a trader you not only have to have a simple, time-tested approach to take advantage of those moves, but you also need the discipline and determination to not let yourself stand in the way of making the trades.

And with that, I’ll leave you with one more thought from Way of the Turtle by Curtis Faith:

“Trading is not a sprint; it is boxing. The market will beat you up, screw with your head, and do anything it can to defeat you. But when the bell sounds at the end of the twelfth round, you must be standing in the ring in order to win.” -MD

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: 14% – Today’s volume was higher than the previous session.

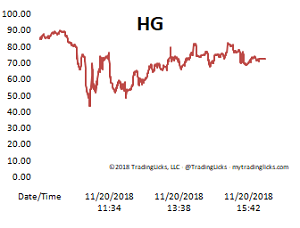

Real Feel: SCORCHING – Bears dominated the session with a minuscule amount of buying under the surface.

Cycle: OVERSOLD II – Retail investors are dumbfounded and are rapidly exiting their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 60%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.