TVO Market Barometer 11-05: Is a post-election plunge upon us?

The mid-term election is upon us and most folks are in “wait and see” mode before what they’re saying could be a big plunge in the market. For big institutions, though, waiting it out is simply never an option, and a distribution filled month of October has apparently given them more than a head start over this Tuesday.

Do they know something already about the outcome that average voters don’t? Perhaps, but their job is to control risk… not much different than traders like you and I, but on a way larger scale. They don’t have the luxury of (nor do they care about) bearish charts and trendlines warning them to get out, or pundits saying “now is the time to go short.” Their actions created those charts in the first place, and while most folks are just starting to look for a way out of the market, they’re already looking for a way to get back in.

TVO, our long-term oscillator, has now reversed towards positive values. Just like price, volume also has a way of reverting to the mean if you know where to look. In the short-term, we may need to blow off steam this week (which may be more the case with the Fed than the election), but for the long haul the shifting of the sands has already begun. -MD

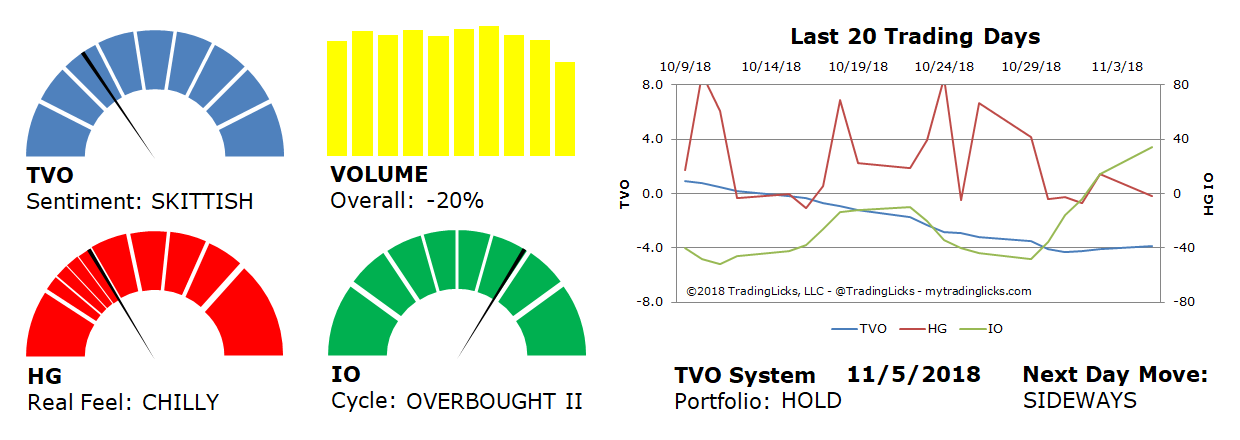

Sentiment: SKITTISH – Market distribution is heavy and aggressive and big institutions are selling to preserve their capital.

Volume: -20% – Today’s volume was lower than the previous session.

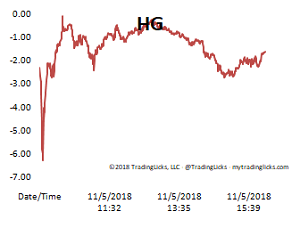

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERBOUGHT II – Retail investors are overly cocky and heavily positioned in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.