TVO Market Barometer 10-10: Is this dip the one or is it time to run?

It’s been a week since the fateful “Presidential Alert” text, and on Wednesday markets finally logged the first across-the-board distribution day in October. You’re probably thinking, how can a simple text wreak so much havoc on the market? Isn’t this just all about rising interest rates?

Well, it is often said there are certain situations that are beyond your control, but what you can always control is the way you feel about it. The news media knows exactly how they want you to feel, and they pump their stories about rates (which everyone already knew were going up) and confirmation hearings (which everyone knew would turn out the way it did) until they get you hook, line and sinker. When you peel away the noise, though, nothing much has changed except the way you feel.

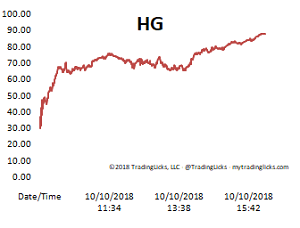

As far as volume goes, Wednesday’s SCALDING Heat Gauge reading is about as hot as they come, so some kind of mean reversion is certainly in order. Of course, our normal mode of analyzing any given situation is often short-circuited by external forces and how they make us feel (And a giant red candle staring you in the face doesn’t help matters much either).

So do we try to catch the falling knife or join the rest of the herd heading for the exits? Well, the best you can do is to stick to your well-organized trading plan and realize that no matter how you feel, the market is going to do what it’s going to do. And if you’re thinking about shorting now, try not to let your feelings get in the way of common sense. -MD

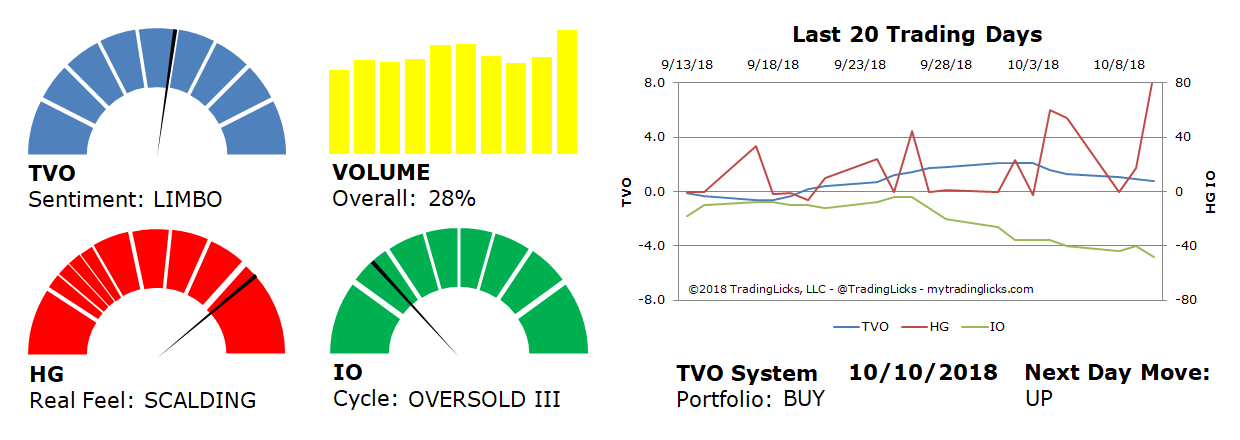

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 28% – Today’s volume was higher than the previous session.

Real Feel: SCALDING – Bears dominated the session and buying was practically non-existent.

Cycle: OVERSOLD III – Retail investors are running for the hills.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 56%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.