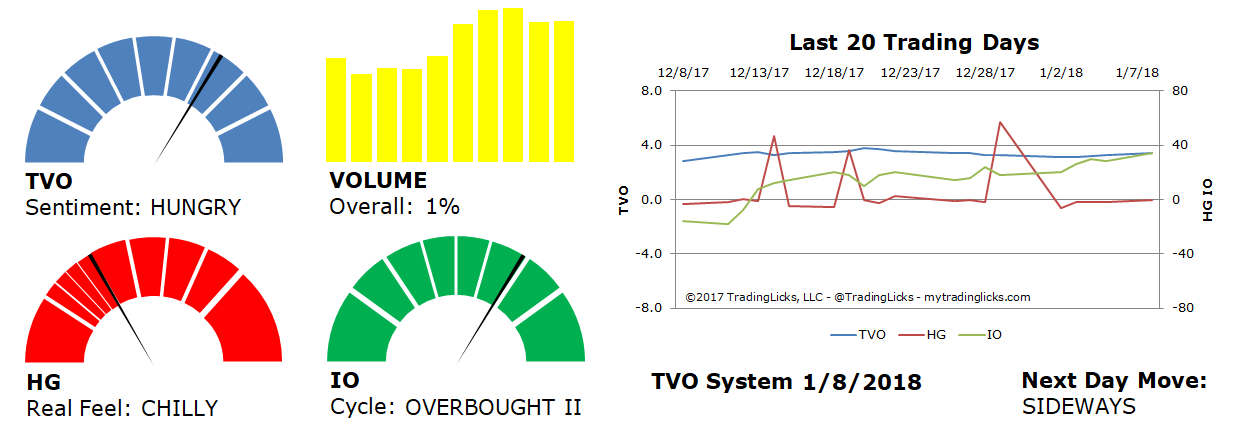

TVO Market Barometer 1-8: Up, up and away, but for how long?

With the fifth trading day of 2018, we’ve had 5 straight days of gains and it feels like a balloon that just keeps going higher and higher. But isn’t this balloon just filled with hot air on short supply, ready to come crashing down? Well, the bears should take note that 3 out of the 5 days were accumulation days for the S&P 500, so the big boys are not too keen on coming in for a landing any time soon.

Nevertheless, 5 days up may need to let off some steam before the next leg of the journey. The last time we went straight up like this was back in October. After that move, we consolidated (with shakeouts along the way) then headed higher. Volume-wise things are similar, as TVO is in the same oscillator range (above 3.0) now as it was then. How it consolidates is anyone’s guess, but one thing is certain: the shakeouts will come. They always do. It’s just a question of when.

One of the biggest challenges in trading is sticking to your guns and following your system… even when it seems like the market has left you behind. So how do we know when it’s okay to break the rules and jump on the bandwagon? The simple answer is: if you follow the herd one too many times, you’re bound to get trampled under foot. Let the trades come to you. They always do. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.