TVO Market Barometer 1-29: It’s time to fasten your seat belts

Bond yields soared and markets turned south as the major indices logged their second across-the-board distribution day of 2018. If you’re a bear foaming at the mouth right now, I suggest you re-read the previous sentence and focus on the word “second.” That’s not to say there won’t be more, but for the time being, bulls still very much have the upper hand, as smart money accumulation (especially on the Nasdaq) has been the predominant January theme so far.

Over confident “inside day” bulls on the other hand, may not want to remain too complacent, as volatility has made a triumphant return. Along with it is the potential for sudden whipsaw moves, specifically designed to take out your carefully placed stops just below those “logical” support levels (like SPY 284 for example).

Our first 2 trades in January brought our overall account YTD return for 2018 to almost +11%. It’s safe to say that some of the big boys are banking their profits as well, so limit risk accordingly, then fasten your seat belts (with SOTU, the Fed and the jobs report on tap this week) for what could be a wild ride ahead. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

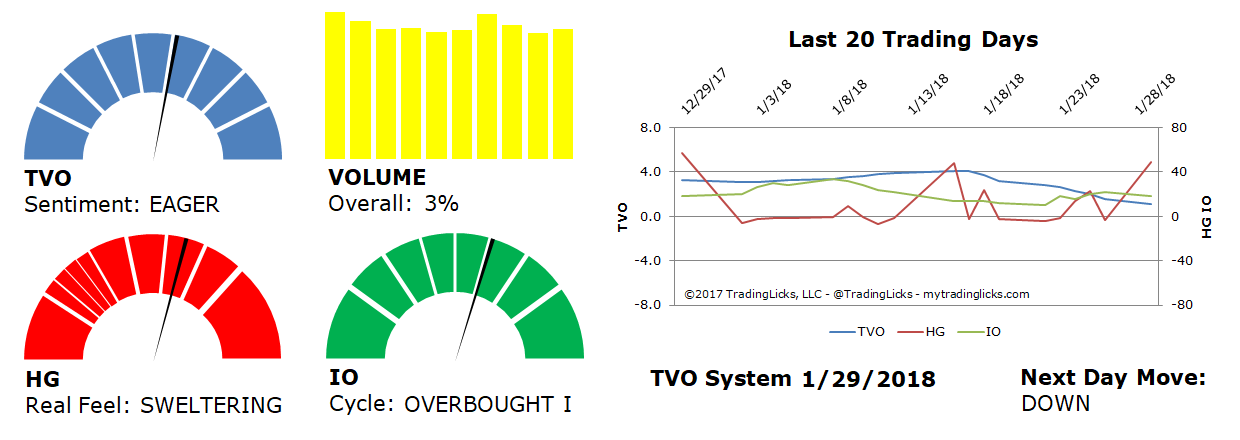

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.