TVO Knows How To Get To The Bottom

The other day I was having lunch with a friend and his investment manager, when they both started to pick my brain about my volume based methods of trading. Usually when discussing a trading system, the subject of bear markets often comes up, which caused my new money manager friend (who spent 20 years on Wall Street working for a certain nameless firm which is now defunct thanks to ’08) to firmly declare, “Never met anyone who could call the bottom… Don’t even think it’s possible and if it is, that guy hasn’t been born yet.”

Looking at the waves of bottom callers (and their track records), that statement seems to ring true. Or maybe that guy or “it” is only a few years old and folks are just starting to catch on. Yes that’s right, we’re talking about TVO (Total Volume Oscillator), who is a child of sorts, but when it comes to catching the trend, the “volume only” indicator (who seems to have a personality all its own), has acquired wisdom and foresight well beyond its years.

So what is TVO’s track record of calling bottoms? Well, when the market drops hard TVO gets it right 100% of the time. In the last 15 years there have been 5 major corrections (greater than -10%) and 2 bear markets (greater than -20%), and TVO called every single one, in some cases almost down to the exact day of the market bottom.

How does TVO do it? The formula for entries is simple. Once the oscillator dips below zero, we just wait for the values to reverse and then buy on the close the following day. The exit criteria is a bit more complicated (a subject of another post), but in each case the market gained 10% on average upon the exit signal. We already wrote about last year’s market bottom in our 2015 year in review, but let’s take a look at some of the others.

First up is the bear market of ’02, not a very bright time as the S&P 500 fell -49.1%, closing at 776.76 on 10/9/02. A week earlier on 10/1, TVO hit -5.1 and reversed, generating a signal to buy at the close on 10/3. It was pretty much uphill from there until the exit on 10/30 resulting in a gain on the S&P of 8.76%.

First up is the bear market of ’02, not a very bright time as the S&P 500 fell -49.1%, closing at 776.76 on 10/9/02. A week earlier on 10/1, TVO hit -5.1 and reversed, generating a signal to buy at the close on 10/3. It was pretty much uphill from there until the exit on 10/30 resulting in a gain on the S&P of 8.76%.

Next is the -14.7% correction of ’03, which sank the S&P 500 to a low of 800.73 on 3/11/03. TVO jumped in a bit pre-mature on this one (2/6), but still managed to capture a 6.61% gain on the S&P by the exit on 4/17. In this case the oscillator dipped down to -4.9 and reversed again after the initial signal at -1, acting as a confirmation and also serving as a point in which to add to the position.

Next is the -14.7% correction of ’03, which sank the S&P 500 to a low of 800.73 on 3/11/03. TVO jumped in a bit pre-mature on this one (2/6), but still managed to capture a 6.61% gain on the S&P by the exit on 4/17. In this case the oscillator dipped down to -4.9 and reversed again after the initial signal at -1, acting as a confirmation and also serving as a point in which to add to the position.

Ok so you’re probably thinking, ’02 and ’03 are all well and good, but that’s ancient history. What about the big one that we all remember? Well, here’s where it get’s interesting.

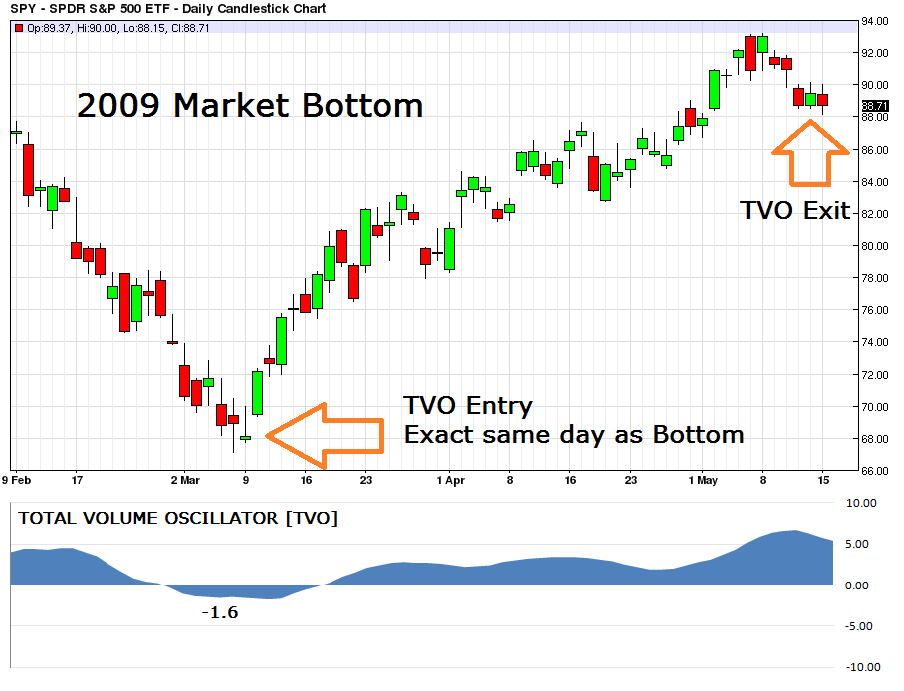

The crash of ’08 eventually came to settle on 3/9/09 when the S&P closed at 676.53, a -56.8% drop off the ’07 high. TVO reversed at -1.6 on 3/5, 2 days before, and signalled to buy at the close on the exact same day of the ’09 bottom. The exit came about 2 months later on 5/14, capturing a gain on the S&P 500 of 32.01%.

The crash of ’08 eventually came to settle on 3/9/09 when the S&P closed at 676.53, a -56.8% drop off the ’07 high. TVO reversed at -1.6 on 3/5, 2 days before, and signalled to buy at the close on the exact same day of the ’09 bottom. The exit came about 2 months later on 5/14, capturing a gain on the S&P 500 of 32.01%.

To stay ahead of the herd with trades like these, don’t miss TVO Daily! Start your Free trial today!

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

S&P 500 data for this article was compiled from “S&P 500 Bear Markets & Corrections Data Table,” Jan 22, 2016, Yardeni Research, Inc., www.yardeni.com

Performance results on this website dated prior to September 2014 for TVO (prior to May 2015 for HG), including backtesting and trade history, are simulated. Please read our full disclaimer.