There’s a bit of churning in the shoulder. – TVO MB 4-03

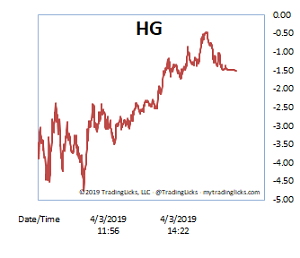

Wednesday’s opening gap on SPY was quickly shot down to earth halfway through the session. The reason appeared to be “left shoulder resistance” (for lack of a better term), preventing the bulls from making much progress price-wise.

On the volume side of things, however, the bulls accomplished quite a bit. There was a steady climb on the Heat Gauge towards warmer temperatures, but levels managed to stay below zero all the way into the close. Oh, and did I mention that there was an accumulation day on the Nasdaq?

So that means we’re going straight back to all-time highs, right?

Well, accumulation does help the bullish case in the longer term, but for the moment, this kind of price action (high volume with little price movement… “churning” if you will) is almost always followed by some kind of a shake-out.

Markets need to let off steam. And the reason why no one sees it coming is because it happens from the inside out. And the action is already well under way, long before the hammer falls. -MD

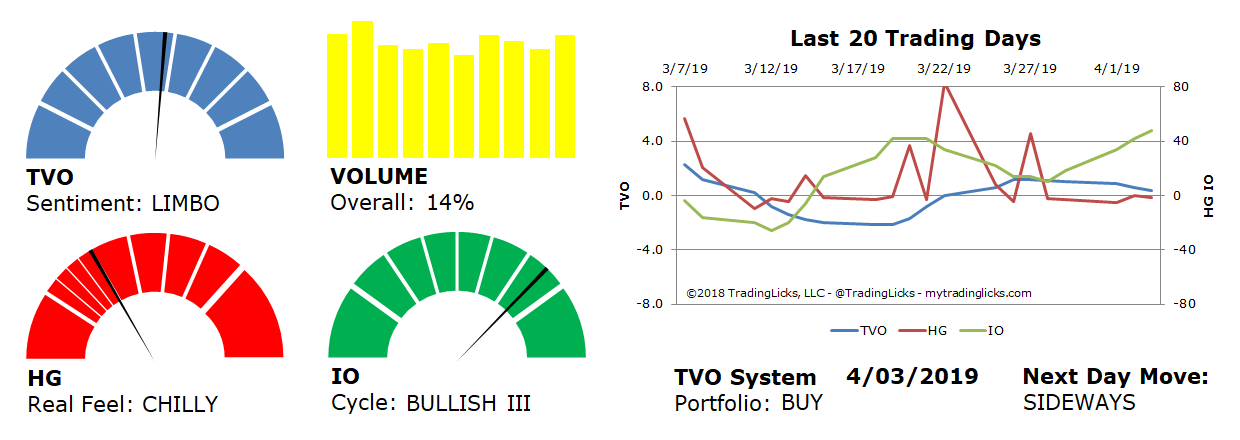

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 14% – Today’s volume was higher than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: BULLISH III – Retail investors have bitten off way more than they can chew.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS – The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.