The road to hell is paved with FOMO. – TVO MB 3-13

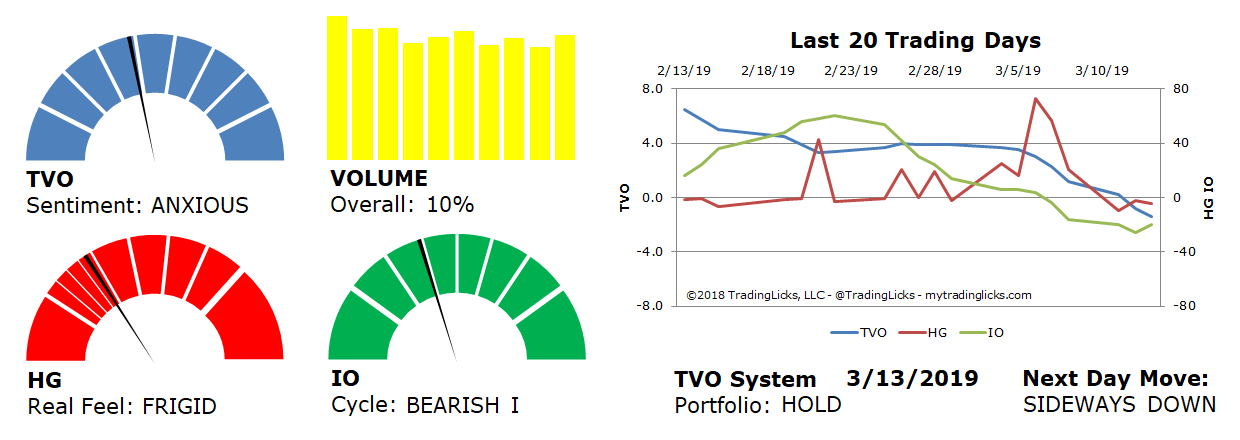

Overall volume jumped a solid 10% on Wednesday, as markets logged the first across-the-board accumulation day this month. TVO, our volume oscillator, has steadily declined since February, as institutional buying (up until now) has been winding down.

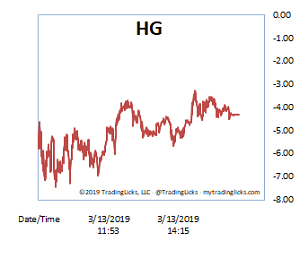

The road to the depths of distribution, however, is sometimes paved with good intentions… and most of the intentions on Wall Street are driven by FOMO (fear of missing out). It’s a bull market party and no one wants to be the first to leave. And looking at the Heat Gauge mostly in the FRIGID range for most of the session, certainly very few market participants are going anywhere at this point.

And you know that FOMO is really starting to kick into high gear when folks like Gundlach and Stockman suddenly pop up on CNBC (as if on cue), both reiterating their eternal bearish biases. Are they actually sitting on huge short positions, waiting for a big drop like an exploding time bomb? Well, if you believe that, then you may want to consider that famous bears like Burry and Taleb, were only famous after the fact, and only because they were lucky enough to live to tell the tale.

It makes you wonder then, that maybe these guys are just saying what they say so that you’ll get scared and sell everything and then they can buy more. Well, in any case, someday their predictions will be spot on, but today is not that day. -MD

Sentiment: ANXIOUS – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: 10% – Today’s volume was higher than the previous session.

Real Feel: FRIGID – Bulls were in control of the session with a fair amount of selling under the surface.

Cycle: BEARISH I – Retail investors are uncertain and very light in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS DOWN -Â The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.