Should we beware the ides of March? – TVO MB 3-14

Thursday’s price action across the indices was a narrow range or an “inside day.” Technical bulls favor such days as they usually indicate consolidation before the next move.

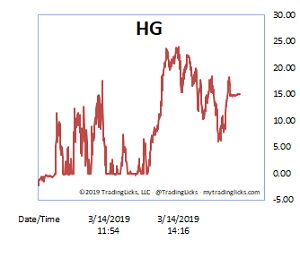

Looking at the Heat Gauge, though, you get the impression that volume may have missed the inside day memo. Huge spikes in down volume were prevalent in the early part of the session, followed by an even bigger jump later in the afternoon. Even though the bears couldn’t get the heat much higher than BALMY, it’s hard to chalk up the day as bullish consolidation by any means.

It’s more likely that the wave of profit taking that typically follows an accumulation day (which happened on Wednesday) is now in progress… after which the “shake-out” will soon follow. And Friday (the ides of March if you will), with SPY ex-dividend and quad witching, is already one heck of a built-in catalyst to get things rolling. -MD

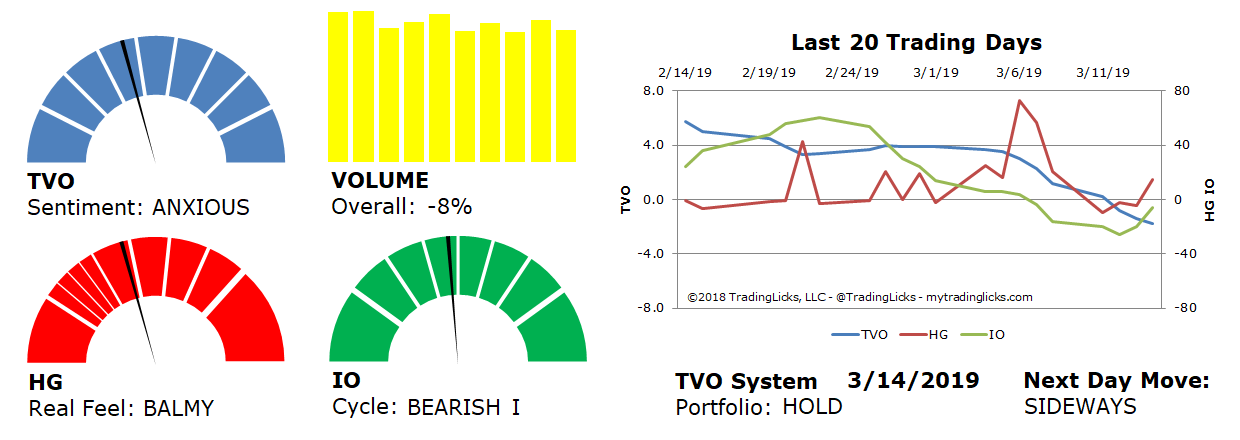

Sentiment: ANXIOUS – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: -8% – Today’s volume was lower than the previous session.

Real Feel: BALMY – Bears were in control of the session with considerable buying under the surface.

Cycle: BEARISH I – Retail investors are uncertain and very light in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.