Market Timing With Volume For A Better Life

It all started just a few years after I became a trader. I came across another trader’s tweet that caught my attention. The S&P 500 had recently dipped below the 200 day moving average, the stock market bears were roaring and most of your average retail investors were running for the hills. The tweet read something like,

If we don’t have a complete market crash in a week, then everything I know about stocks is wrong and I shouldn’t be trading.

The words sounded like they came from a true trade-o-holic, and the thought behind them was one that I found all too familiar.

Well, as you might have guessed, the crash didn’t happen. In fact, the market went back to record highs, and that trader’s avatar disappeared from social media without a trace. I knew just how they must have felt, though, because I have had that same feeling of doubt about the market far too many times. And listening to all the talking heads and market pundits, I know I’m not alone. I wish I had a dime for every time I’ve read a notable expert quoted as saying “in all my “X” years of trading, I’ve never seen anything like this before.”

So how do we keep up and make sense of a market that doesn’t seem to make any sense? My search for a better way to cut through it all, and ultimately rescue myself from the madness, led me to create what I call TVO.

What is TVO?

TVO stands for Total Volume Oscillator. Through examining years of advance/decline volume data (going back to 1978), I came up with my own method of analyzing the ratio between the two. The result is an oscillator that indicates whether the market is overbought or oversold. Some folks might recognize this idea and describe this kind of thing as a “breadth” indicator, but most of those incorporate price into the equation, where TVO doesn’t.

How did you come up with the idea?

What are we missing to be so fooled by the market so many times? I had done so much in-depth analysis on price and trends, cross referencing every type of indicator, until I realized that maybe price is actually the problem. If prices are the reflection of investors perception of value, and that perception can become distorted by countless factors like elections, bank bailouts, etc., prices, therefore, can be misleading. So if price doesn’t matter, what are we left with?

Volume was something I hadn’t paid much attention to. And I’m not talking about the little bars at the bottom of all the charts. I use to use those and found that they can be just as misleading, too. After compiling raw end-of-day overall market volume data, and organizing it in an Excel spreadsheet, the true direction of prices became clearer and easier to recognize. Then I thought, why not develop a system where price is ignored entirely?

Is it really possible to use volume alone to time the market?

Yes that’s certainly what the data was telling me. I found that by using a change in direction of daily Oscillator values as entry and exit points, I was able to design a long-short market timing system for the S&P 500.

I traded SPY options, and rather than use stops or target prices, I decided to limit risk by making the position size/number of contracts no more than 10% of total capital. The maximum loss in any given trade is the premium paid for the contract. A loss of premium due to time decay is pretty much ruled out as the system makes sure the options are always closed at least 30 days before expiration. And since the gains on options are often as high as 50-200%, the reward can outweigh the risk quite substantially.

How does it perform?

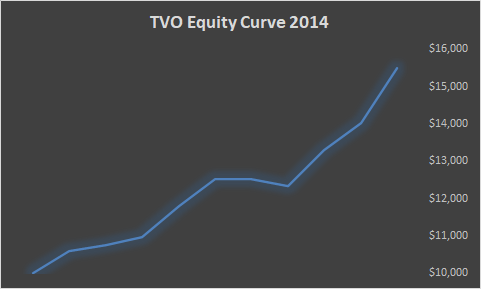

In 2014, a $10,000 account grew over +50% with an 80% win rate and average gain per trade of +116% (To see how the system has performed since 2014, please view our Trade History). TVO overall produces a pretty smooth equity curve with consistently profitable returns using only volume data without any regard to price.

Also a plus is that TVO catches only the big long-term swings that happen a few times per year, which makes it very easy to use and track. I was relieved that the days spent trying to find just the right “live” day trading chat room service were no longer needed. And with less trades, I didn’t have to watch the market all day, leaving more time for other things in life I enjoy.

Can a more hands on trading approach return greater profits? Possibly. But low maintenance means lower stress, and I’m sure for some of my fellow trade-o-holics out there, the trade-off is worth the peace of mind and better quality of life you’ll receive.

Why does it work so well?

How can all this be possible without any regard to price or chart patterns? It’s the big institutions that move the market. When they decide it’s time to buy or sell, a surge or drop in volume literally lights up their trail. In contrast, Fed meetings and other events can pump up prices to unrealistic highs and then shakeout the weak hands after devastating drops without the slightest bit of warning.

TVO ignores all of the noise and identifies the trend with one of the few stats that can’t be easily manipulated… Volume. If you’re trying to find the real truth behind market moves, you needn’t look any further.

Big volume sets the trend. All you have to do is catch the wave.

And TVO is only part of the story. In the next post we’ll check out the Heat Gauge (HG). -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!