Is the selling over or more to come?

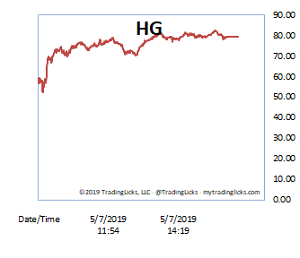

Markets plunged at the open on Tuesday and gave the bears the high volume distribution day they’ve been hoping for since the end of March. It was starting to look like it was possible for TVO to level off in the bullish 0-3.0 range, but today’s rout stepped in the way of that plan.

Once again, tariffs are setting the stage for the selling with the “tweet heard ’round the world” taking most of the blame. The tariff tweet was on Sunday, though, while the current market pullback was already in progress since the sudden rejection of all-time highs on the S&P 500 last Wednesday.

Take away the news and all the hype and what you’re left with is a technical pullback and nothing more. Unless of course you believe that somebody knew something (someone always knows something, but that’s a subject for another post). Anyway, the takeaway here is that, if you try to time the news and the tweets, you’ll find in retrospect that the market moves don’t quite line up with the news trigger events as well as you thought.

Overall volume surged 20% in today’s session, which is actually a good thing for the bulls because a jump in volume usually happens at either end of the swing cycle. Case in point: last Tuesday we had 23% volume increase, which turned out to be the day before the top of the swing last Wednesday (mentioned above).

It turns out you don’t really need to follow news, pundits or tweets because high volume acts to frame these market swings almost perfectly… kind of like bookends. Today’s dip may not be the last one before all-time highs are once again tested, but you can be rest assured that volume contains a story that’s always well worth reading. -MD

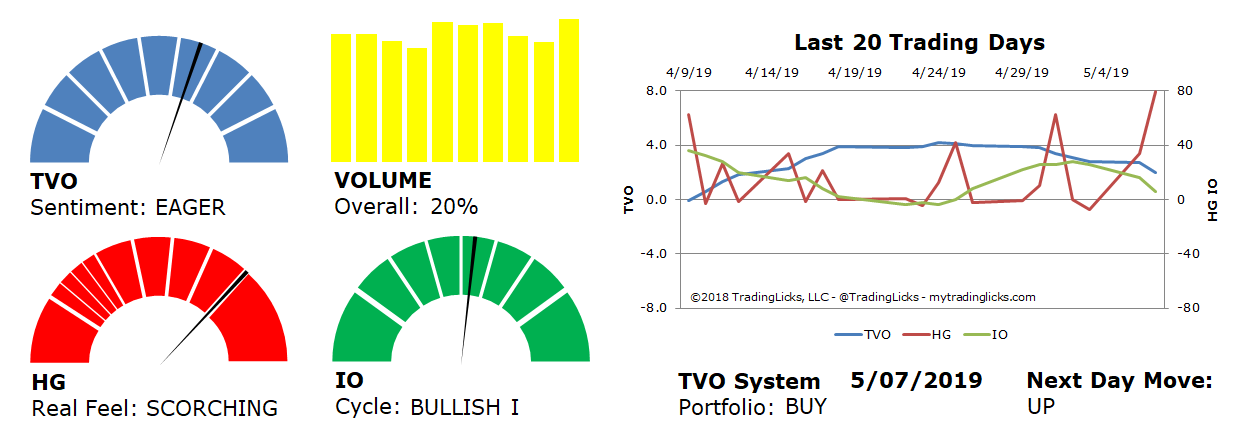

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: 20% – Today’s volume was higher than the previous session.

Real Feel: SCORCHING – Bears dominated the session with a minuscule amount of buying under the surface.

Cycle: BULLISH I – Retail investors are confident and slightly overweight in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 59%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.