If you don’t like the market, get used to it. – TVO MB 3-15

These days, the market seems to take everything in stride no matter what gets thrown at it. Last Friday’s Quad witching barely raised an eyebrow, as volatility continues to shrink.

Overall volume did jump 64%, which is a pretty large amount even for options expiration, so we’re bound to see some kind of cause and effect. Whether it’s the much anticipated shakeout or a non-stop blast back to all-time highs, remains to be seen.

One thing is for sure… whether we go up or down, you can always count on it lasting much longer than you thought was possible.

Up here in New England we have a saying that goes, if you don’t like the weather, wait a minute. On Wall Street, if you don’t like the market, you better get used to it.

There are still plenty of things coming up (like the Fed this Wednesday for instance) that could upset the apple cart. The one catalyst that will end up doing it, though, is the one you never see coming. In any case, there’s not much you can do except take things in stride and be ready when it comes. -MD

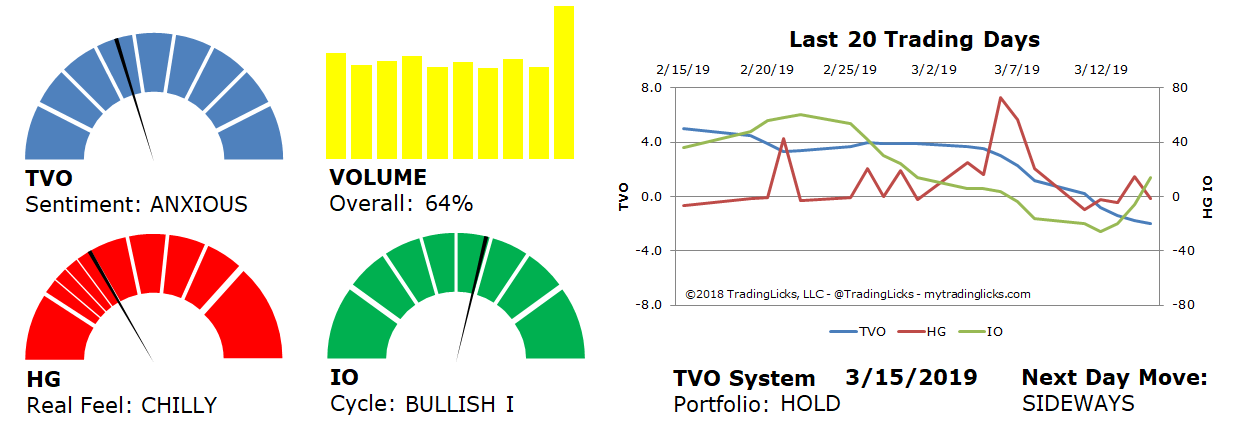

Sentiment: ANXIOUS – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: 64% – Today’s volume was higher than the previous session.

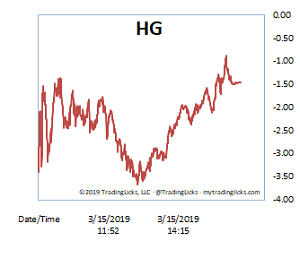

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: BULLISH I – Retail investors are confident and slightly overweight in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.