Cover Before June, Not A Moment Too Soon

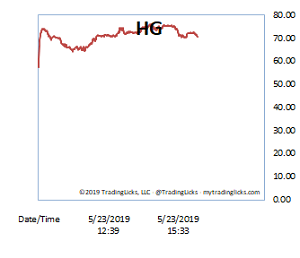

All hopes for the 50 day moving average buy program quickly evaporated this week, as more and more distribution began taking hold. Our Heat Gauge stayed solidly in the SCORCHING range for most of Thursday’s session, even taking into account the bulls last ditch rally effort in the final hour of trading.

The good news for the bulls, though, is that overall volume reached almost 20%, which is often a sign that the move may be exhausted, especially when markets are at prior support levels (SPY 280 may have previously been a “psychological” level, but there’s a lot more riding on it now). Whether the bears are just taking a short breather remains to be seen, although with 4 distribution days already under their belt this month, covering before June (and not a moment too soon) seems the likely scenario. -MD

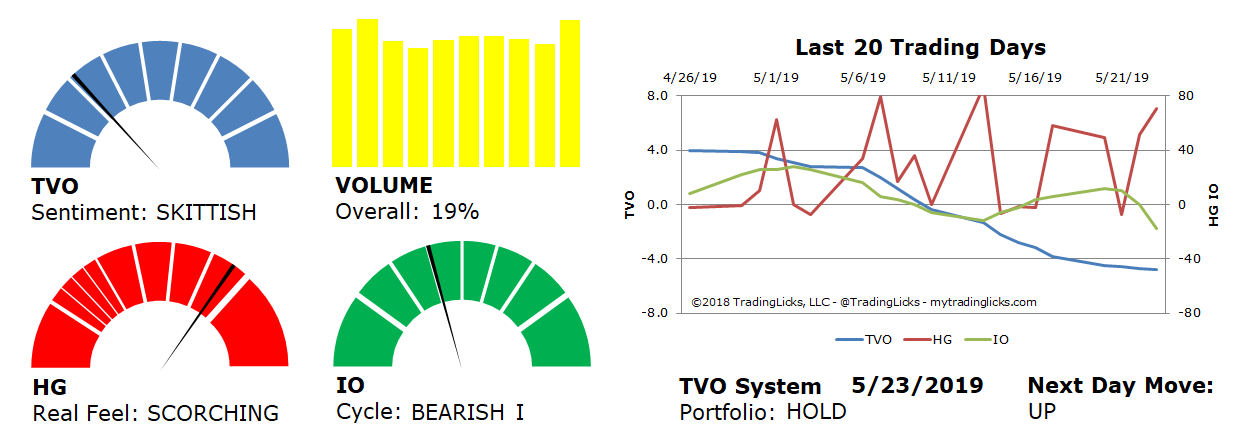

Sentiment: SKITTISH – Market distribution is heavy and aggressive and big institutions are selling to preserve their capital.

Volume: 19% – Today’s volume was higher than the previous session.

Real Feel: SCORCHING – Bears dominated the session with a minuscule amount of buying under the surface.

Cycle: BEARISH I – Retail investors are uncertain and very light in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: UP – The probability that SPY will close positive in the next session is 59%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.