Can Boeing take down the entire market? – TVO MB 4-08

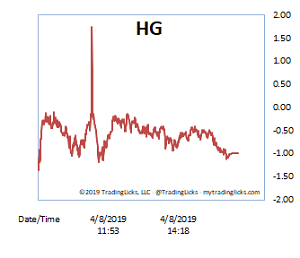

There was a drop at the open on Monday, which led to a quick recovery by the end of the session. Other than one huge down volume spike around 11am, the Heat Gauge was mostly calm in the bullish CHILLY range.

Some folks are blaming the morning drop on Boeing, as the Dow took a much bigger hit price-wise than the other indices. Can one stock really create a ripple effect that can take down the entire market?

Well, I think if you’ve been trading long enough you know the sensible answer to that question. The market, however, is famous for not making sense and Wall Street is always looking for some kind of scapegoat to put the blame on.

Of course, markets wouldn’t just magically implode over Boeing unless there was something already wrong brewing under the surface. Whether the culprit is China, the Fed, or the border wall is up for you to decide. Right now our Portfolio approach says to HOLD, so on the sidelines is the place to be. -MD

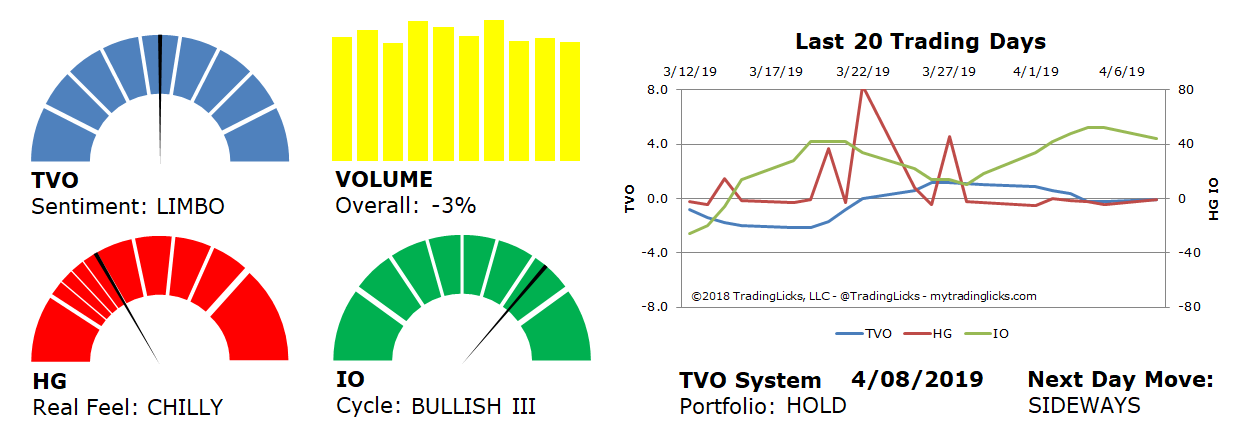

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -3% – Today’s volume was lower than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: BULLISH III – Retail investors have bitten off way more than they can chew.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.