Are We There Yet? The Week In Market Volume

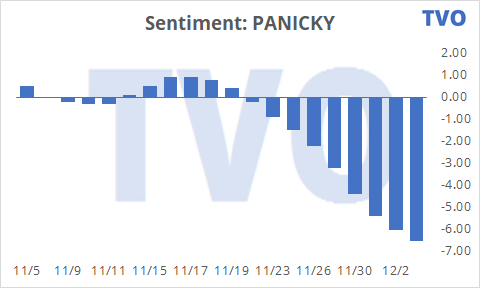

Last Friday, SPY had a wide range outside day (meaning both the high and low eclipsed the previous day’s levels) and magically came to rest at the close right on the 50 day moving average. Our Market Volume Barometer sentiment is “PANICKY” and it’s saying that “Big institutions are having an all out liquidation sale.” This does look to be the case as we haven’t seen an accumulation day on a major index since 11/12.

So, does this mean that it’s time for traders to close up shop for the year?

Well, think of it like this… I can remember being in the middle of a drive to somewhere and getting the feeling that I should have already been there by now – This was, of course, in the days before GPS – And then just minutes after I felt the urge to turn around, suddenly the destination appeared on the horizon. Markets in correction mode are designed to make you feel the same way. You get to thinking that something should have happened by now, and this often results in the all too familiar “sell at the bottom/get out at all costs” scenario.

So how do we know it’s really a bottom and not just another stop on the way down?

If you look at our Total Volume Oscillator, or TVO, you’ll see that it’s in negative territory approaching -7.0. The oscillator has never gone below -10.0 (going all the way back to 1965), and when it gets close to -10.0, a reversal is soon to occur. Big long-term price movement is almost always preceded by similarly big moves in market volume. Like a GPS, TVO can tell your destination is coming long before it appears on the horizon. And the way that TVO is now setting up for a reversal, the subsequent price rise to follow in the indices is looking to be quite substantial. We’re not there yet, but for now, we’re looking to stay on the road for just a bit longer. – MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!