Are we looking at an obvious short? – TVO MB 2-04

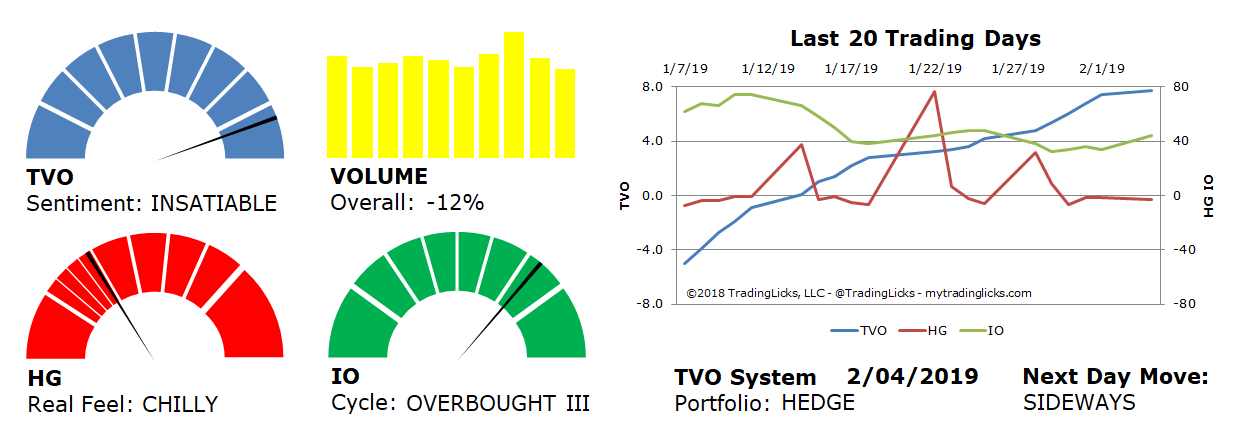

It’s been a month since the market has seen any sign of distribution. In that time TVO has climbed from -6.0 to almost +8.0, very close to the top of the scale.

Overall volume is starting to decline, and if that continues, the oscillator will begin to reverse towards negative values.

Does this mean we’re looking at an obvious short?

Well, there are tons of technical folks out there that can give you tons of reasons why the market is set to reverse at this point… I’m not going to be one of them.

All I can say is we sold our SPY 244 calls today for a +184% gain, bringing our 2019 YTD return to +16%, erasing the majority of our losses for 2018.

We’ll be watching for TVO to head back down before we look for another long-term entry. Whether the market keeps rolling higher until then is anybody’s guess, but a shakeout from here would certainly not be unexpected. -MD

Sentiment: INSATIABLE – Big institutions are buying like there’s no tomorrow.

Volume: -12% – Today’s volume was lower than the previous session.

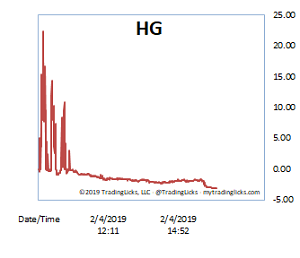

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERBOUGHT III – Retail investors have bitten off way more than they can chew.

Portfolio: HEDGE – The market is over saturated and long-term investments warrant some protection.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.