Was This A Bad Week To Tune Out The Noise?

Markets snapped back on Tuesday after Monday’s blow and seemed to surprise a good many folks out there… Even though that’s what extremely oversold markets usually do. The price action did lose some steam which prompted some hope from all the “dead cat bounce” shorts.

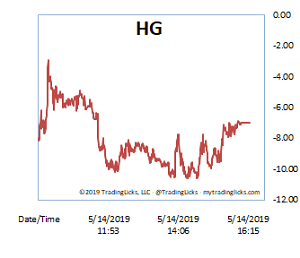

In the volume department, however, Tuesday was a clear win for the bulls with the Heat Gauge treading at FRIGID or below most of the session. It was much like a reverse of Monday’s SCALDING day, except on much lower overall volume.

But wait a minute… How can low volume be good for the bulls at this point?

Well, a high volume day would mean that the snapback has already started to peak out, as those who were caught in the dip too early are often in the process of struggling to break even. With lower volume (-15%) there’s a much better chance of the rally just getting started, as most of the big boys are staying right where they are.

As for the trade war thing, in this “deal or no deal” environment it’s really tempting to constantly check the news for the slightest sign of a resolution. I know you’re probably thinking that this was probably a bad week to start tuning out the noise in your trading. Frankly, there will be times when you’ll feel great that you didn’t listen to the news, and then there will be times you wish you did.

The real question is not whether it was good or bad timing, but rather what kind of a trader do you want to be? Are you good with spending your days in front of the screens, or would you rather be free to spend them some other way? If you don’t choose one way or the other, you’ll always be wondering if you’re doing the right thing.

Warren Buffett said you should be able to make money while you sleep. I’d say as long as you’re doing it and living the way you want, you’re on the right track. -MD

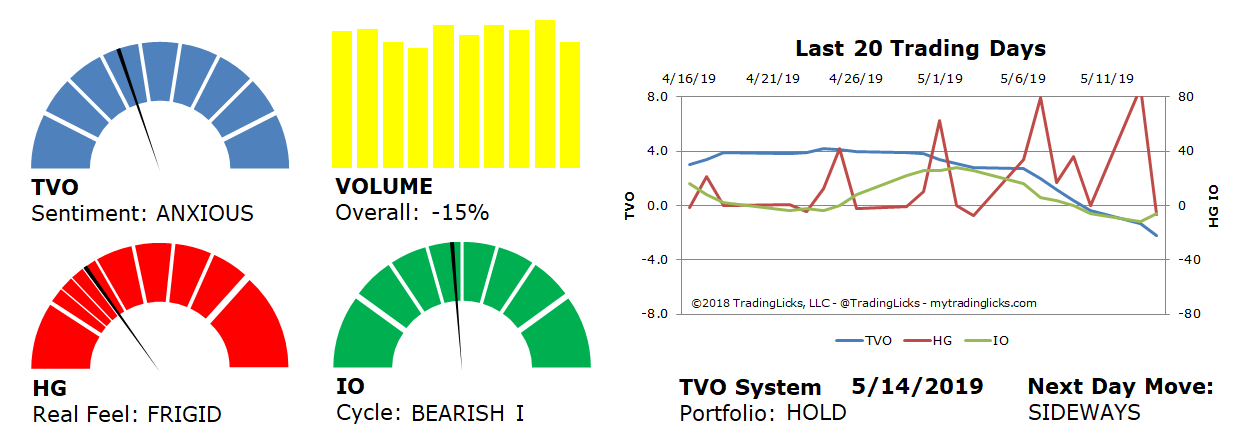

Sentiment: ANXIOUS – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: -15% – Today’s volume was lower than the previous session.

Real Feel: FRIGID – Bulls were in control of the session with a fair amount of selling under the surface.

Cycle: BEARISH I – Retail investors are uncertain and very light in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.