Is this the pride before the fall?

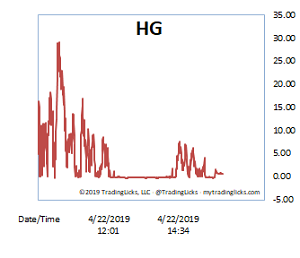

If you leave out the drop at the open, Monday’s trading range on SPY was a little bit less than a dollar, mostly centering around the 290 area. If you take a look at volume, though, the range of activity was much wider, with spikes on the Heat Gauge extending from COOL into the TORRID level.

Am I here to tell you that there’s trouble brewing and a market crash is soon upon us?

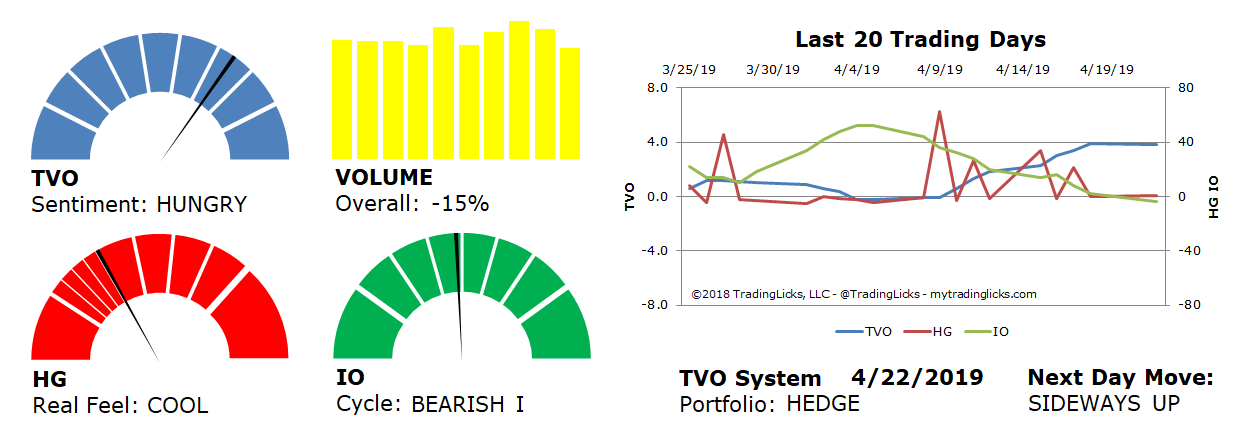

Well, not exactly, as internals are still pretty solid in the longer term perspective (TVO has just reversed towards negative values, but just above 3.0 is not horribly overbought). And there are plenty of confident bulls out there who are all settled into this “more of the same” market… And who can blame them?

I’m just saying that, ideally, consolidation in a tight range at the highs would be a lot less concerning if volume was also behaving the same way. If you follow our motto that “volume precedes price”, then it’s possible that things may be setting up for a rough ride in the next week or two. -MD

Sentiment: HUNGRY – Markets are accumulating at an accelerated rate and big institutional buying is heavy and aggressive.

Volume: -15% – Today’s volume was lower than the previous session.

Real Feel: COOL – Bulls and bears were at a stalemate for the session.

Cycle: BEARISH I – Retail investors are uncertain and very light in their holdings.

Portfolio: HEDGE – The market is over saturated and long-term investments warrant some protection.

Next Day Move: SIDEWAYS UP – The probability that SPY will close positive in the next session is 54%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.