TVO Market Barometer 7-27: Is the market going to take a bite out of Apple?

Last Friday’s GDP number was quite impressive, but for some reason the market was not very impressed (sell the news, perhaps?), as the major indices promptly fell off a cliff. The blame was pointed towards the FANG stocks (because the media has to blame something), and was largely shrugged off by the bulls, who are looking at those long red candles as simply a buying opportunity.

The coming week’s events make quite a list, with more than a quarter of the S&P 500 reporting earnings. Also there’s the jobs report, the Fed, and it’s the end of the month. And while FANG may be in the rear view mirror, the market has yet to sink its teeth into Apple, which is also on tap to report earnings this week.

With all of that going on, anyone who thinks they can predict the market direction this week by looking at a candlestick, better have a backup plan. Or they might want to start looking at volume and market internals.

Our Issues Oscillator, which is based on such internals, got us out of our calls at Friday’s open with a +32% gain… right in the nick of time before the slide. Our total account return for the month of July is now up to +11%.

Why does the market always seem to sell off after good news? Well, good or bad, by the time the news hits the stands, the market has already moved on to the next item at hand.

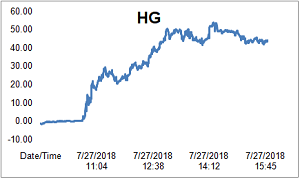

Are big institutions now re-positioning themselves for an Apple or Tesla miss, or was Friday’s dive just a SPY 280.50 gap fill and nothing more? TVO, our long-term oscillator, is still in the healthy market range, but retail investors are quite shaky at the moment. Overall volume fell in the previous session, so it’s likely that we’re in the midst of a shakeout that’s just getting started. -MD

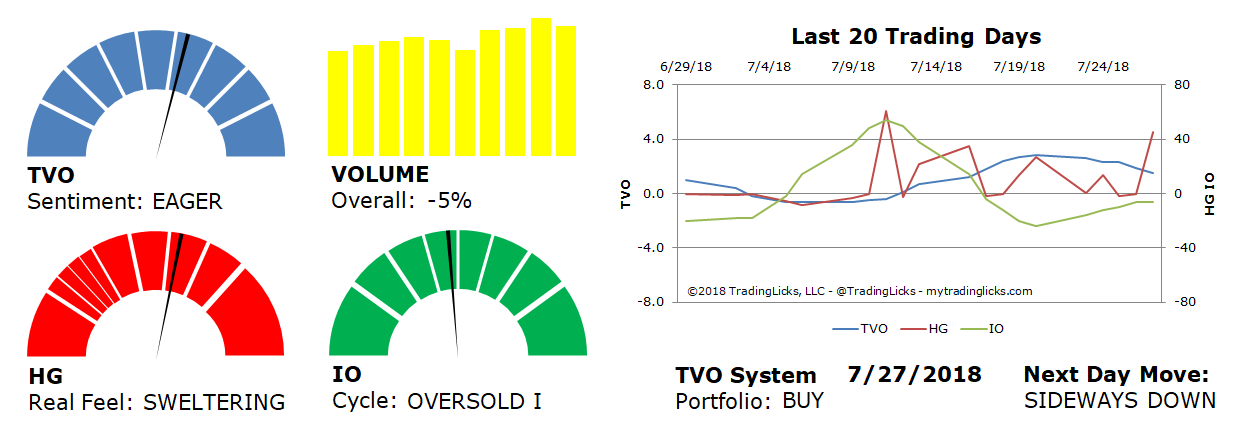

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: -5% – Today’s volume was lower than the previous session.

Real Feel: SWELTERING – Bears were in control of the session with a slight trace of buying under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS DOWN -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.