Swing Trading Big Moves With Market Volume And The Heat Gauge

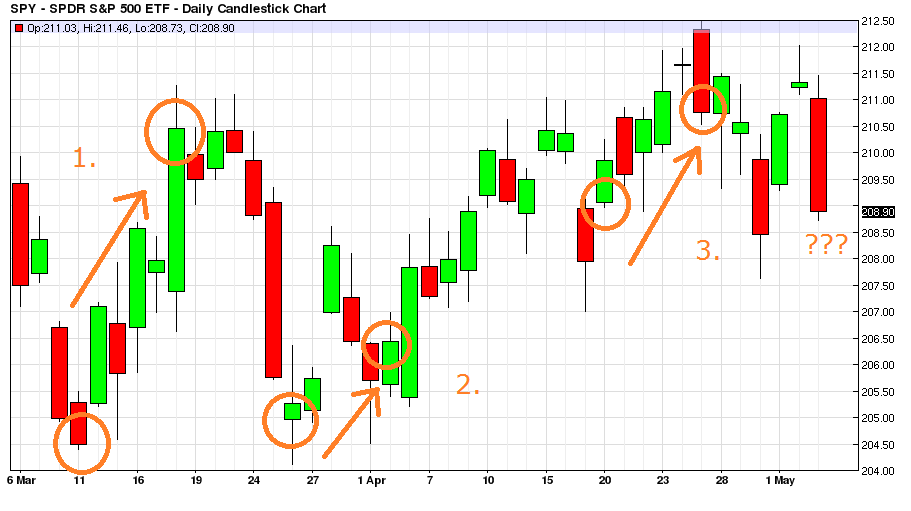

We now know that it is indeed possible to time the market using only volume with TVO. By itself, TVO captures the major market swings without breaking a sweat in just a few trades per year. But what if you’re a more active swing trader looking for even higher gains or just a little more excitement? Well, the Heat Gauge, or HG, is right up your alley. Here are 3 options trades showing how the Heat Gauge, using only volume data, called the major swings over a 2 month period in 2015.

1. On 3/10 things are heating up and HG was SCALDING at +82, pretty hot for March, so on 3/11 we bought SPY 206 calls at the open for 2.47. By 3/18 things cooled down a bit, a FRIGID -7 on HG, and we sold our calls at the close for 5.59, a 126% profit.

2. 3/25 we’re back up to our unseasonable warmth at a SCORCHING +74. On the next day once again HG catches the very bottom of the swing, using only volume data from the night before, and we bought SPY 205 calls at 3.63. On 4/2, HG is a CHILLY -3 and we sell at 4.28 for a 17% gain.

3. On Friday 4/17, fear was pretty high in the market, and HG was pretty hot at +77. On Monday 4/20 we bought SPY 210 calls and sold them near the top of the swing a few days later for a 6% gain.

So how does it work and how did it come about?

It started as something sitting right in front of my face and I still couldn’t see it. Or maybe I just didn’t want to. In technical trading, this happens quite often, which is part of the reason I steered away from chart pattern analysis and conventional indicators. But the “safer ” world of backtesting and quantitative strategies is not without its pitfalls.

One of the reasons I developed TVO (Total Volume Oscillator), was so that I could in effect remove myself from my trading. Having a proven system at the helm steering you through the markets, allows you more time for other stuff you enjoy. I wanted to spread the word, so in 2014 I started writing about volume and TVO in the TVO Market Barometer blog. My hope was that my fresh perspective on volume would enlighten other traders and help them with their trading as well.

In the beginning, it apparently did just that, and maybe a little too well.

Right off the bat after the first few posts, several day traders wrote me with accolades for “calling the market,” which was a bit surprising considering most of my comments were just daily analysis based on raw volume data and were not really meant to be trading signals. Anyway, at that time, I was much more focused on the longer term swing signals that TVO was generating. Nonetheless, traders were successfully managing to profit in the short-term from my market volume analysis.

I was somewhat intrigued, to say the least.

Then it hit me that maybe there was something there. Just maybe there was a way to measure what I was seeing in the numbers and then develop a system to capture the short term swing moves. I was still a recovering trade-o-holic, so any new system would have to be low maintenance to ensure that I wouldn’t be tempted to follow the herd and dive back in again to full time day trading status.

After crunching some numbers I came up with an algorithm that measures volume like a thermometer. I called it the Heat Gauge, and the concept of trading it was simple… When it gets hot, get in the market and when it cools down, get out or go short. And by hot I mean the mercury is rising or just about ready to boil.

In 2015, HG was added to the TVO System.

TVO and HG got together in 2015 and sparked a union that became a match to be reckoned with, beating the S&P 500 (dividends included) by almost 30%. Both trading systems (which are based on market volume data alone) generated signals resulting in 30 round trip trades yielding a 53% success rate with gains on individual options trades reaching as high as 146%.

The average gain on winning trades was close to 50%, out weighing the average loss by nearly a 2:1 payoff ratio. Higher percentage winners out numbering lower percentage losers is a key ingredient for a system to ultimately be profitable… Even with a -10% correction in the S&P that year, TVO and HG stayed ahead of the game in 2015 with a cumulative 2 year return at just over 80%.

Why does volume work so well?

You may not want to believe it, but in today’s market, volume is really the only leading indicator. It’s the big thing under everyone’s nose that many folks overlook or they just refuse to see it. Everything else, including price and every indicator related to it, is so often manipulated by Market Makers and Wall Street professionals and therefore should be suspect. Follow volume and you’ll stay one step ahead of the herd.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!