What’s the secret to big returns? Doing nothing.

Volatility came back with a vengeance on Monday as the latest saga in the China trade war managed to throw yet another wrench in the works.

It’s days like this that makes me realize the benefit of having a trading system that centers around selling into strength and low market exposure. At the close last Friday, while the S&P 500 was up almost +1%, we sold our SPY calls for a +16% gain and moved to 100% cash… which was right in the nick of time before today’s drop at the open.

So far in ’19 we’ve made close to a +20% YTD return with a just over a dozen round trip trades. All entries and exits were made at the close only.

No watching the market during the day. No chart patterns. Absolutely no regard to price of any kind. You don’t need any of those things because the proper analysis of volume tells you everything you need to know.

Sure, the S&P 500 is up around 17%, and some folks might say that you should be able to get the same kind of return by “doing nothing.” But to claim 17% you would’ve at least had to have bought SPY in early January (when SPY was in the high 240s) and held it until now.

Well, anyone that’s traded for at least a few months (or a few weeks even) knows that buying market lows while most of the world is in a panic is definitely not “doing nothing” and is easier said than done.

Not to mention the fact that you would’ve been 100% exposed to all kinds of market whipsaws and volatility. The TVO System limits risk and cuts the exposure time in half (our market exposure is 30-50%) with the added benefit of reducing your stress levels by at least that amount.

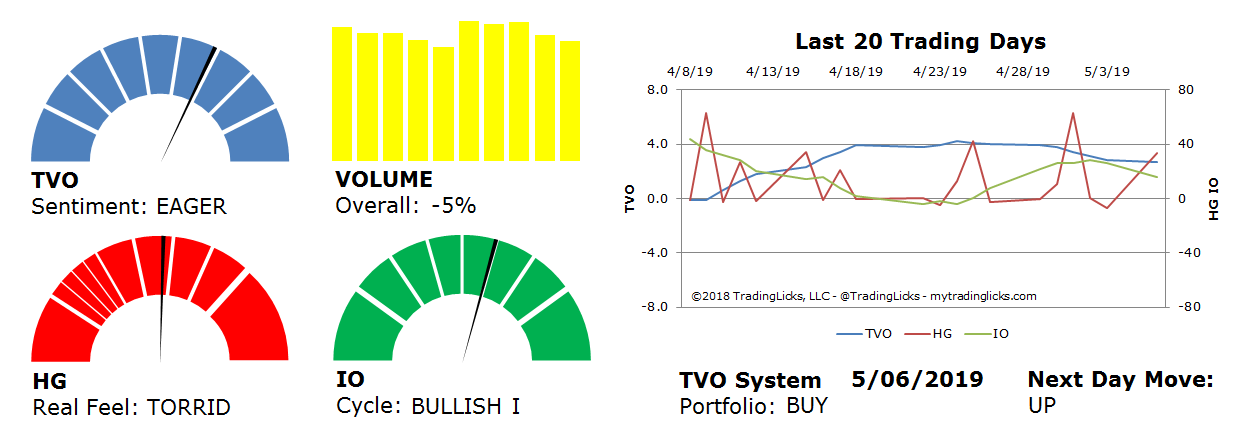

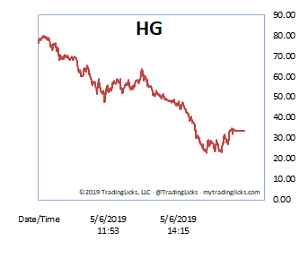

Looking at volume today, the morning plunge never really got much traction. Overall volume fell by the close and our Heat Gauge settled in at TORRID, which is a way’s off from the kind of “sell in May” distribution the bears were hoping for.

The VIX is still high, so it’s likely the ride will be a bit bumpy in the next few sessions. TVO is now in “BUY” mode, so as long as institutional investors continue to hold (or as some may say, “do nothing”), the melt up will ultimately continue. -MD

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: -5% – Today’s volume was lower than the previous session.

Real Feel: TORRID – Bears were in control of the session with moderate buying under the surface.

Cycle: BULLISH I – Retail investors are confident and slightly overweight in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 59%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.