TVO Market Barometer 9-4: Is it the perfect time to buy the dip?

The first trading day of September gave what many bulls would consider to be a “picture perfect” pullback (as far as charts go) on SPY. The problem with charts, though, is if you can see it, so can the rest of the trading world… and an ever-present bearish contingent is counting on just that fact.

The bulls on the other hand, retain their confidence as they continually put all faith in Newton’s law, which is that “all objects in motion tend to stay in motion.” The problem with that is that most folks often leave out the 2nd part, “unless acted upon by an outside force“… And there may be a just few of those forces waiting in the wings. Canada, China, Turkey, etc. come to mind.

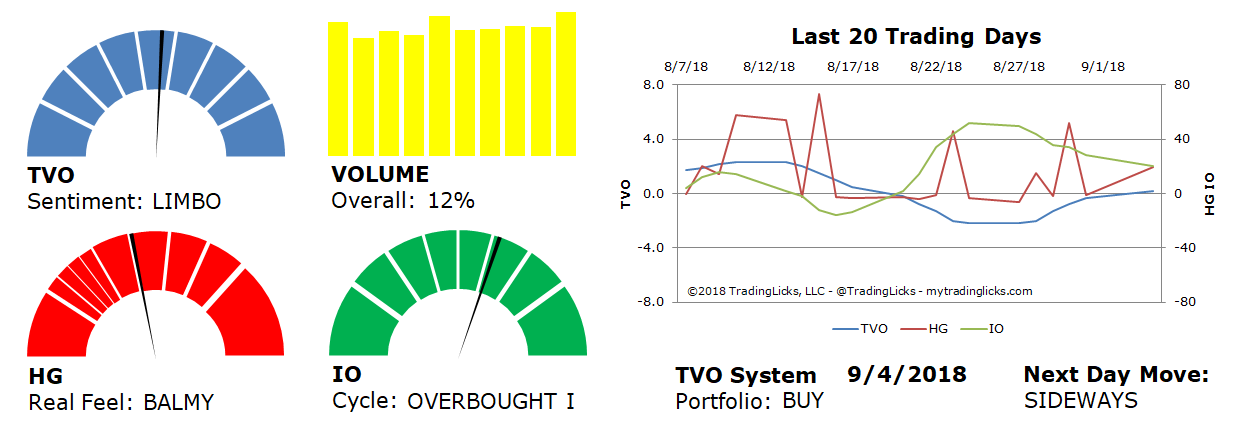

The Big Board logged some distribution on Tuesday, but the 288 gap on SPY was spared to the penny (another suspicious detail of our “perfect” pullback). The indices were in a tight range price-wise while overall volume rose 12%, so perhaps there’s a bit of churning (ie. big institutions positioning themselves for a big move) going on under the hood. TVO, our volume oscillator, has risen above zero putting our long-term portfolio approach back into BUY mode. That could be short-lived, though, if selling continues this week.

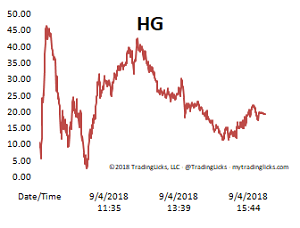

Our Heat Gauge was on the BALMY side, but not hot enough to trigger a long entry. In fact, we’ve been in cash with options for over a week (after an exceptional 10 trade winning streak since July that netted our total account with a +23% gain). We’ve had at least 3 close calls to go long, but HG has kept us on the sidelines as the market continues to move lower.

It’s a short week ahead, but action packed nonetheless, with Fed remarks, election results, a confirmation hearing, and the jobs report… just a few more “outside forces” to kick off the month. – MD

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 12% – Today’s volume was higher than the previous session.

Real Feel: BALMY – Bears were in control of the session with considerable buying under the surface.

Cycle: OVERBOUGHT I – Retail investors are confident and slightly overweight in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 55%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.