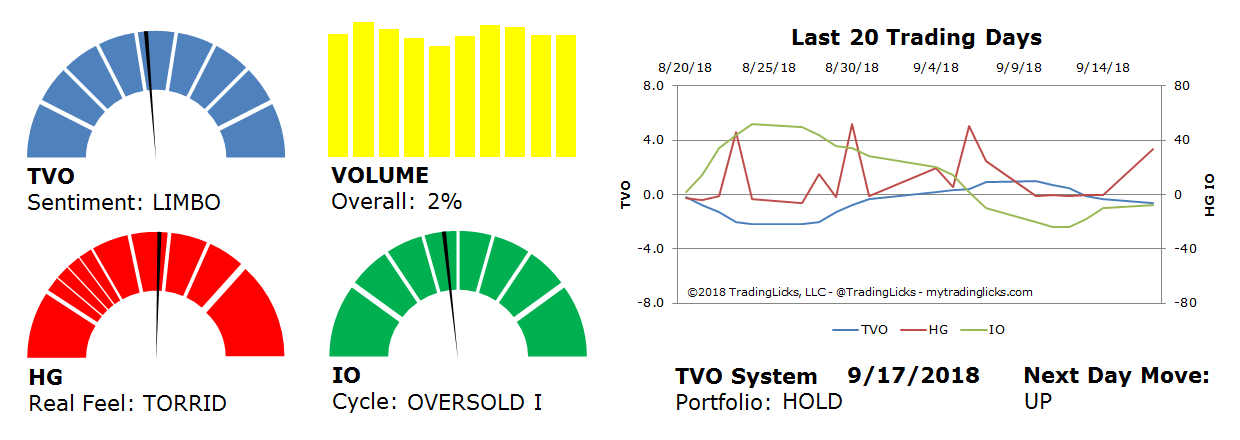

TVO Market Barometer 9-17: Double top or double dip?

Markets took a dive at the open on Monday, and before the “no new lows after 11am” crowd could get their longs going, SPY double dipped into the 290 gap and then some. This clear price rejection at so-called resistance levels (double top or whatever you want to call it), has got a lot of bears saying we better look out below. The folks who shorted SPY at the close may want to look at things from a volume perspective, however, before adding to their positions.

All the major indices fell, but only the Nasdaq saw any amount of real distribution. Meanwhile on the big board, advance/decline volume was about even, which basically means that even though so-called “key support levels” didn’t hold (and everyone’s got their own favorite number for those), the dip was already quietly being bought.

Whether it was enough buying to spring us back to new highs remains to be seen, but since TVO is still in LIMBO, in the long-term we’re not putting too much faith in either direction. The short-term, though, is another story altogether. -MD

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 2% – Today’s volume was higher than the previous session.

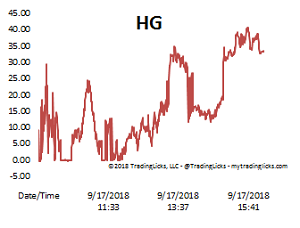

Real Feel: TORRID – Bears were in control of the session with moderate buying under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 59%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.