TVO Market Barometer 8-29: It’s like deja-vu all over again.

The Big Board squeezed out another accumulation day on Wednesday while markets continue to astonish and push higher and higher. The tides are apparently shifting as the distribution phase that ushered in the month of August is now slowly being swept out to sea.

As records continue to be broken (as they are inherently made to be), folks just can’t help pointing out the “eerie similarities” to the calm-before-the-storm market conditions of the past. And who can blame them, as we all love a good story, especially ones that can potentially help future generations avoid catastrophe (aka the “I told you so” crowd). The warnings usually go like, “You better watch out, because this has only happened x amount of times” or “The last time this happened was 1929, 1987, etc.

As a trader, though, if you’re interested in consistent profits, you may want to pay more attention to events that happen more frequently (like 40 or 50 times), rather than the few and far between. So if you’re waiting around for that once-in-a-lifetime market crash to go all-in on the dip that may or may not ever come, well, let’s just say you’re in it for life.

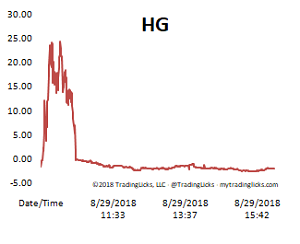

In the volume department, TVO, our volume oscillator, has now reversed and is getting closer to positive values, which could soon shift our portfolio status to BUY mode. When big institutions decide it’s time to go in, broken records and rare coincidences are not too high on their agenda.

And what exactly is their agenda? Only time will tell, but volume is telling us it’s already well underway. -MD

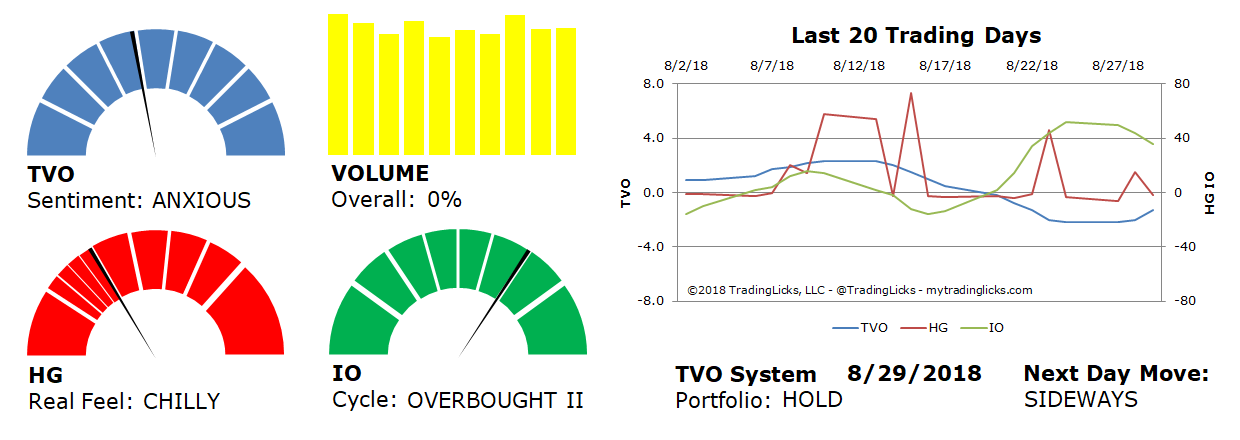

Sentiment: ANXIOUS – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: 0% – Today’s volume was higher than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERBOUGHT II – Retail investors are overly cocky and heavily positioned in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.