TVO Market Barometer 7-09: Has the market finally gone crazy?

Back from the holiday week, markets rallied hard on Monday in what was the 2nd across-the-board accumulation day in July… a month not exactly known for heavy investor participation.

So what exactly is inspiring all the buying amidst the tariffs and trade war shenanigans? Well some experts out there are saying the market is just plain crazy, and that ignoring the risks will soon have consequences.

These are among the same folks who once said “sell everything” just in time for the market to hit bottom. The last one of these warnings came at the end of March, which in retrospect looks pretty much like a bottom now if there ever was one.

And they must be looking at price because their knack for making these calls right at prior price support and resistance levels is downright uncanny. Doing the opposite of what many of these “experienced” managers suggest is really starting to look like a pretty viable trading strategy.

It doesn’t take an expert to notice that the first mention of tariffs was about a month prior to the aforementioned March bottom. Big institutions have had the information since then (and who knows how long before that), so why would they wait until now to suddenly realize their apparent crazy lack of risk management and run for the hills?

The answer to that question is they didn’t, because they can’t.

Their positions are far too large and take weeks if not months to build. It’s absolutely necessary for their risk to be well-baked into the process. By the time the average investor gets dealt the cards, the big players have already moved on to the next hand.

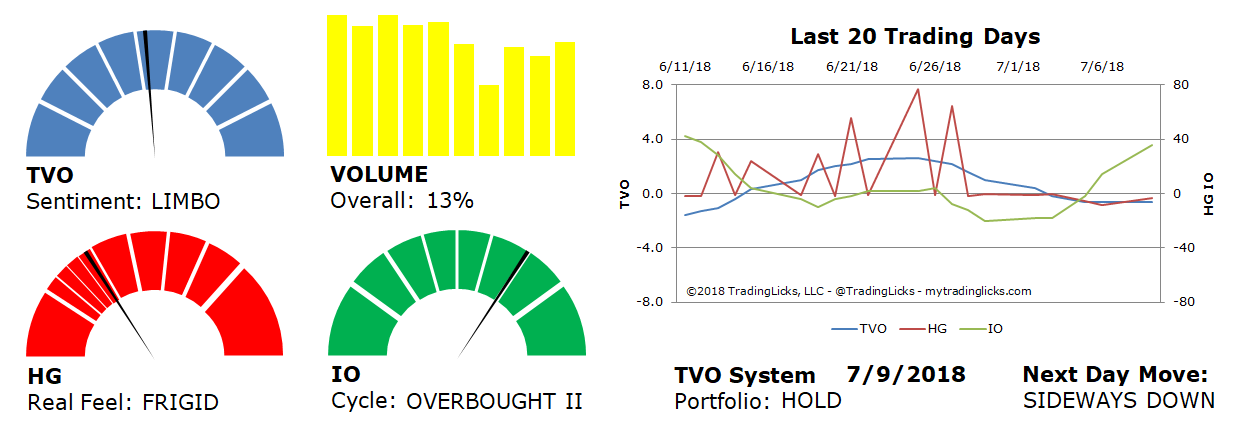

Right now TVO, our volume oscillator, looks to be bottoming out just below zero and a day of digestion at the highs could cause the values to reverse. This would put our long-term portfolio firmly back into BUY mode. Conditions are OVERBOUGHT in the short-term, but not at the high levels that one might assume from looking at price.

Because after all, looking at price and ignoring volume does have its consequences. -MD

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 13% – Today’s volume was higher than the previous session.

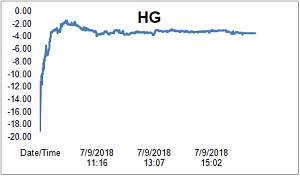

Real Feel: FRIGID – Bulls were in control of the session with a fair amount of selling under the surface.

Cycle: OVERBOUGHT II – Retail investors are overly cocky and heavily positioned in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS DOWN -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.