TVO Market Barometer 7-06: Are we in the fast lane to new highs or stuck in the shoulder?

According to Bulkowski’s Encyclopedia of Chart Patterns (which is a must-have for all traders whether you trade off patterns or not), the Head and Shoulders pattern has a 93% success rate, is highly reliable and you don’t have to wait for the neckline to break before trading it.

Also the pattern is highly recognizable, and because it’s so easy to spot it often becomes a self-fulfilling prophecy.

As far as the one that’s currently forming on SPY, however, the big institutions are just not seeing it that way at the moment. Last Thursday, overall volume rose 53% (the left shoulder is supposed to have the high volume, not the right) as markets logged an across-the-board accumulation day, paving the way for last Friday’s gap and go above SPY 275.

Seems the big boys may have returned early from vacation last week to make sure the H&S does just the opposite of what most folks expect.

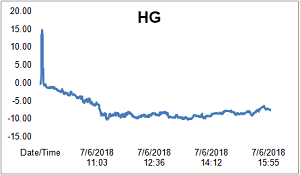

But what about the news of the trade war that hedge fund legend Ray Dalio recently said has now officially begun? Many investors rely on Dalio and others as a gauge of market sentiment (They all may be short or even aggressively long for all we know). But how can the market continue and break the recent sideways trend in the midst of an economic scenario like this?

Well, when it comes down to it, it’s not what you, I or even what Ray Dalio thinks about the news that matters. What matters is how the market reacts.

As a trader you can attempt to anticipate that reaction by listening to Dalio, looking for chart patterns, etc. In the end, though, it’s the market that is always right (and never obvious), no matter how much you disagree.

In fact, your successful edge as a trader may very well depend on how comfortable you are with being uncomfortable. So when market reactions go against you, the best thing is to stay informed (read up on those patterns you think know), and above all stick to your system.

Because the time you start getting too comfortable following the crowd, may be just the time to start looking for a new path. -MD

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -7% – Today’s volume was lower than the previous session.

Real Feel: 3-DOG NIGHT – Bulls dominated the session with selling kept to a bare minimum under the surface.

Cycle: OVERBOUGHT I – Retail investors are confident and slightly overweight in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 57%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.