TVO Market Barometer 6-27: Just when I thought I was out… they pull me back in

On Wednesday, in what started as a decisive bounce off the 50 day ma, the S&P 500 quickly retreated to below that infamous line in the sand to end the session less than 50 cents away from where it traded in the first week of 2018.

It would be hard to find a better example of what is quintessentially the definition of a “sideways market.”

As we enter July with the S&P flat for the year, our 5 in a row winning streak of May has been cancelled out by June’s volatility. Our options account has moved slightly back in the red.

The takeaway from all of this? Simply put, trending, not sideways, markets are where it’s at.

Oh yes, there are some folks who say sideways markets are easy to play because there are “well-defined” support and resistance levels. Well, I say let me know how you make out with that.

Then there’s the other camp that says when things get choppy and sideways, they just sit it out in cash. The problem with that is often you don’t really know you’re stuck in a non-productive trading range until you’re well into it.

Most market participants are wishful thinkers and want to believe that the next swing is the one that will kick off the new trend. Of course every time it looks like it’s starting to develop in either direction, it fails over and over again to the point that everyone finally throws in the towel… and that’s the moment that the real trend quietly begins.

How long before that moment happens in the current market is anybody’s guess, but one thing is certain… It can’t stay sideways forever.

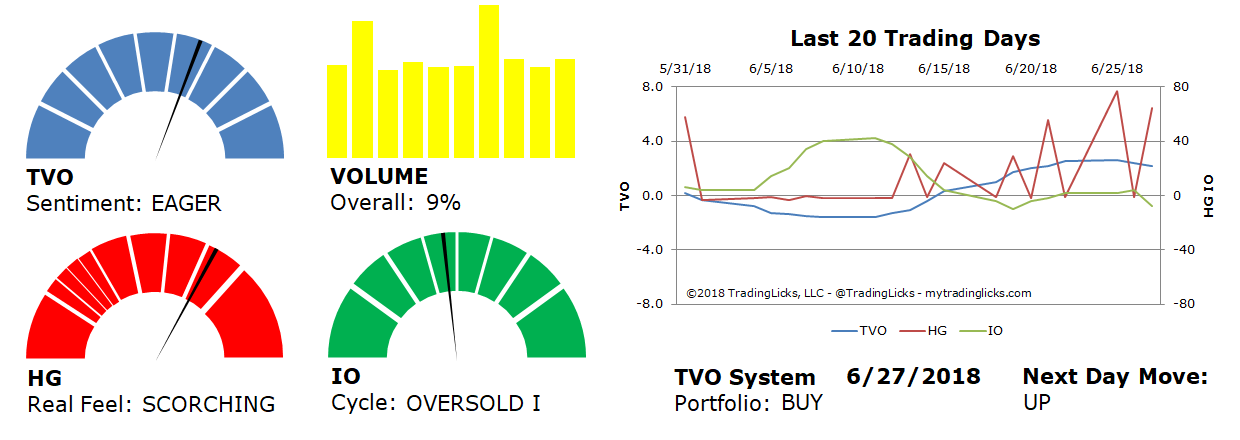

From a volume perspective, TVO, our long-term volume oscillator reversed on Tuesday (putting me, as always, into a very apprehensive state), which is almost always followed by some kind of turbulence. While the oscillator values are now headed in the direction towards a distribution phase, we are still in the bullish healthy market range (TVO is between 0 and 3.0) where it’s a good time to add to your long-term portfolio.

So For the time being enjoy the discounts while they last, because with the start of Q3 and the Fed on tap for next week, the sideways market may in for a bit of a game change. -MD

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: 9% – Today’s volume was higher than the previous session.

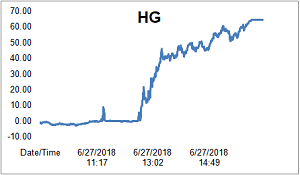

Real Feel: SCORCHING – Bears dominated the session with a miniscule amount of buying under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 59%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.