TVO Market Barometer 6-05: Which way is the market headed?

After last Thursday’s drop, the bulls maintained control of the ball, filled some long-lost gaps and now all-time highs are once again reality… which is really interesting considering that the big institutions have been missing in action for almost a month now. That’s not to say that they’ve disappeared altogether because other than last Thursday’s rout, across-the-board distribution has been off the table since April.

So what exactly is making this market go higher? Well for one thing, when selling and buying are at equal odds, the market inevitably falls back on its “default mode” which is to go up. Which gives me a reason to issue this reminder (and shamelessly quote myself from Chicago Sean’s Podcast 2 weeks ago): “If it didn’t go up, then why are we doing it?” Put that together with the element of recent time spent in a trading range, and you’ll see that if you’re not certain which side to bet on, there’s always one side that probability certainly favors.

Folks are also starting to say that turbulence and volatility in the markets are back and here to stay, which is very good news for swing traders no matter what side you’re on. Whether the next pullback happens before SPY hits 280, remains to be seen. As far as TVO is concerned, though, our calls from May are back in the money and we’re holding long-term until volume tells us otherwise, as price targets (especially the obvious ones… as most are) are never a part of our plan. -MD

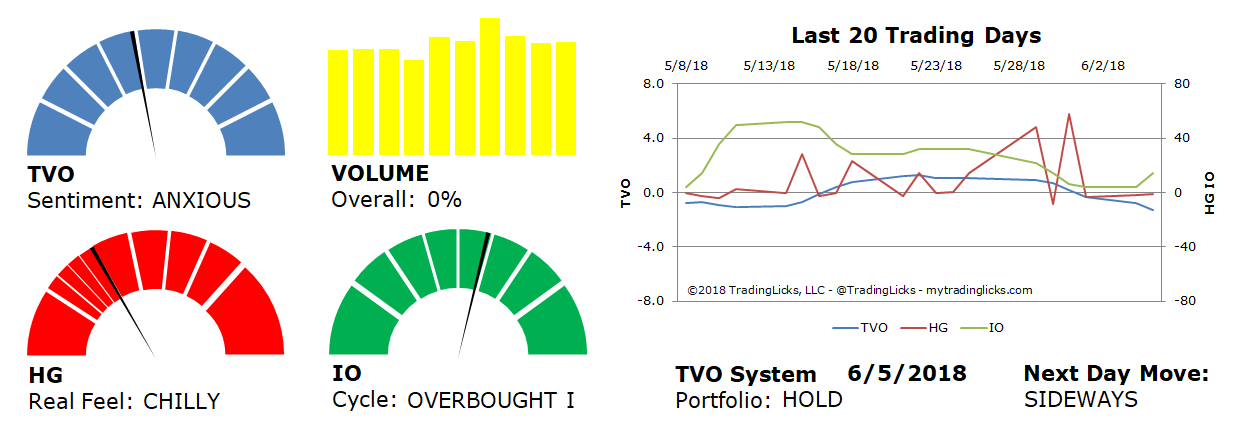

Sentiment: ANXIOUSÂ – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Sentiment: ANXIOUSÂ – Markets are in a distribution phase where big institutions are selling to reduce their exposure.

Volume: 0%Â – Today’s volume was the same as the previous session.

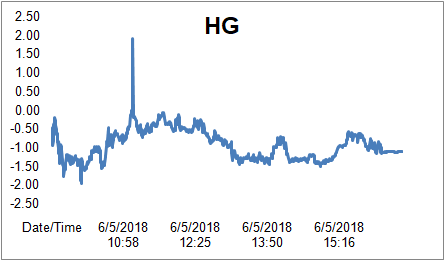

Real Feel: CHILLYÂ – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERBOUGHT IÂ – Retail investors are confident and slightly overweight in their holdings.

Portfolio: HOLDÂ – The market is in period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYSÂ -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.