TVO Market Barometer 5-29: Is Italy really a concern for markets?

After the long weekend, talk of another Italian election shook up markets on Tuesday, as investors made their way for the exits on overall heavy volume. And while the prospect of an Italian exit (“Quitaly” anyone?) was generating concern on the big board, the folks over on the Nasdaq seemed to be saying “Non mi importa” as they narrowly avoided a volume distribution day.

During the SWELTERING session, advancing volume did manage to hold its ground in the tech heavy index, but statistically speaking this type of volume action does not usually produce a bullish outcome in the near-term. So was today’s dip just all about filling the SPY 270 gap, or is there more downside in store? Well, IO reversing direction is a positive towards the case for a bounce from here, but the market may need to flush out more weak hands (the 50 and 200 day ma are a stones throw away) before all is said and done. -MD

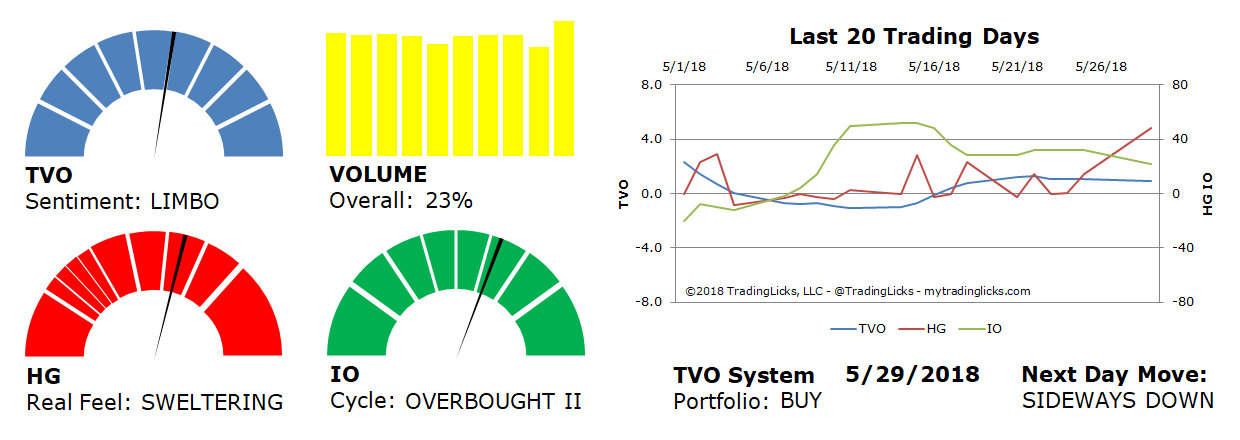

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: 23% – Today’s volume was higher than the previous session.

Real Feel: SWELTERING – Bears were in control of the session with a slight trace of buying under the surface.

Cycle: OVERBOUGHT II – Retail investors are overly cocky and heavily positioned in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS DOWN -Â The probability that SPY will be positive in the next session is 51%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.