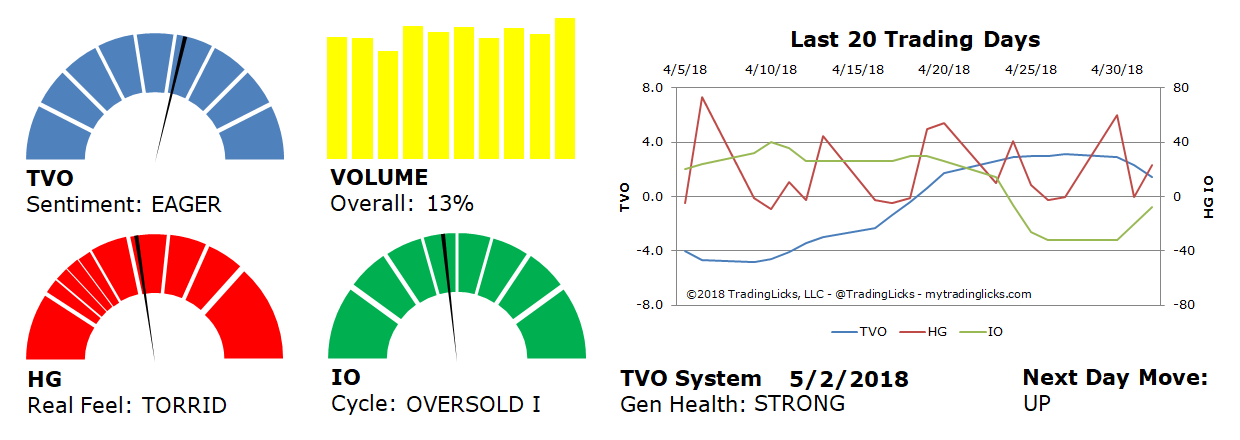

TVO Market Barometer 5-2: Sell in May is already underway

The month of May has begun and according to the old Wall Street proverb, folks are supposed “sell in May and go away.” Well, according to TVO (our long-term volume oscillator), which topped out at +3.0 a week ago and started to reverse, big institutions have already gotten a head start on the selling part.

As for “going away”, that still remains largely to be seen. SPY currently seems to be caught between the moon and New York City (aka the 50 and the 200 day MA… not currently a Wall Street proverb, but it could become one), and IO (our issues oscillator) has started climbing with short-term OVERBOUGHT conditions close at hand.

And if they’re getting ready to leave, what exactly is causing investors to keep such a close eye on the exits? With earnings this quarter coming in well beyond expectations, is a strong dollar and the rocketing 10 year really enough to send them packing for an early vacation?

Perhaps market makers have one more shake out planned with their sights set on the stops just below SPY 261. We will know soon enough. In the meantime, when you get caught between the 50 and the 200 day, the best that you can do is stick to your plan. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.